COPYRIGHT CLAIM:

Sarawak Report is currently disputing a copyright claim issued by a non-existent company in the US, which is demanding that pictures of Jho Low cavorting at Cristal champagne drenched parties in public places in the South of France and United States be removed from public view. These pictures have been available and widely circulated on the web since 2010 (shortly after the PetroSaudi joint venture was signed). However, we are now informed that an undisclosed person has approached the original copyright owners and bought the rights to these pictures for an undisclosed sum. They are now posing as a celebrity pictures agency and utilising this copyright to exploit the new so-called DCMA laws, designed to reward copyright holders, to demand all these pictures are brought down. We argue that this is a misuse of the law by a non-existent company for the ulterior purpose of concealing information and that it violates the public interest by retrospectively hiding once public pictures, which illustrated the ostentatious show of wealth on the part of Jho Low. Meanwhile, since the world has already seen the photos anyway, we are replacing the disputed pictures of Jho Low with photos from the animal kingdom. We trust readers will accept this compromise while the dispute procedure gets underway.

In the January following the 1MDB PetroSaudi Joint Venture, an emailer calling themselves “Number One” sent PetroSaudi Director Patrick Mahony some answers for a Star Newspaper Journalist, who had provided a list of questions for PetroSaudi International, which had just announced its buy out of the Sarawak bank UBG.

Question 1) There is speculation/expectations that this deal involving UBG, will eventually see the involvement of one of your jv partners 1MDB. Is this true and why (not)?

Answer: The move to acquire, privatise and delist UBG is envisaged as a venture to be undertaken solely by PetroSaudi International…..

…. Question 4) There is a cynical view that the deal is in some ways, a bailout of CMSB [Cayha Mata Sarawak Berhad], controlled by the Sarawak Chief Minister’s family. Your comment please

Answer: PSI is a reputable international company owned by Sheikh Tarek Obaid jointly with the Royal Family of the Kingdom of Saudi Arabia. Our main objective is to look for good partners and value propositions for our stakeholders. We have no interest in the fortunes of CMSB…

From: Number One

Date: Wed, 13 Jan 2010 17:52:09 0800

Subject: response to the star re ubg

Attachment(s): 1

From: Number One

To: [email protected]

Date: Wed, 13 Jan 2010 17:52:09 0800

Subject: response to the star re ubgEmail to of The Star.

1) There is speculation/expectations that this deal involving UBG, will eventually see the involvement of one of your jv partners 1MDB. Is this true and why (not)?

Answer: The move to acquire, privatise and delist UBG is envisaged as a venture to be undertaken solely by PetroSaudi International. As part of our corporate strategy, PSI enters into joint-ventures with different partners or sometimes chooses to go it alone when the occasion or opportunity demands for us to do so. PSI’s JV with 1MDB will afford significant opportunities in the energy sector in the Middle East and this region but is a separate venture from the one PSI is pursuing with UBG.

2) As far as listed construction companies are concerned, there are several industry stalwarts in the country that make attractive takeover targets. Why did you pick UBG? What value can it bring you?

Answer: PSI were presented with several possibilities but none had the full suite of options which were looking for, namely not only having a strong construction arm but also upside in oil and gas. It is also a plus that UBG’s subsidiaries – Putrajaya Perdana and Loh & Loh – have a strong niche in the respective areas.

3) The plan would involve delisting UBG from the stock exchange. What do you plan to use UBG as a vehicle for and which sectors primarily and would it necessarily involve purely the construction sector?

Answer: PSI and UBG complement each other with their own unique strengths and capabilities. Our upstream oil & gas expertise will add value to UBG’s existing investments in the sector while we see ourselves benefitting from UBG’s strength in constructions and water infrastructure. This relationship offers a unique opportunity for mutual value creation.

4) There is a cynical view that the deal is in some ways, a bailout of CMSB, controlled by the Sarawak Chief Minister’s family. Your comment please

Answer: PSI is a reputable international company owned by Sheikh Tarek Obaid jointly with the Royal Family of the Kingdom of Saudi Arabia. Our main objective is to look for good partners and value propositions for our stakeholders. We have no interest in the fortunes of CMSB.

One can speculate on the identity of this spokesman for UBG/ CMS.

However the identity of the Number One person in charge of Sarawak at that time was never in doubt.

It was Taib Mahmud, whose family had scandalously enjoyed an almost 100% ownership of UBG bank until quite recently.

Under pressure to sell out and facing less profitable times for banking anyway, the Taibs had been engaging in a number of deals regarding UBG.

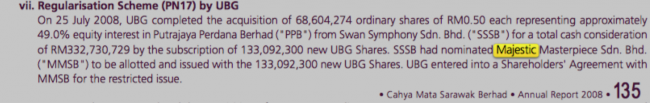

In May 2008 the then public company expended a nominal sum acquiring a 51% shareholding in a newly incorporated Cayman Island company called Unity Capital International, which in turn had 100% ownership of a SNG$2million Singapore subsidiary called Unity Capital Management.

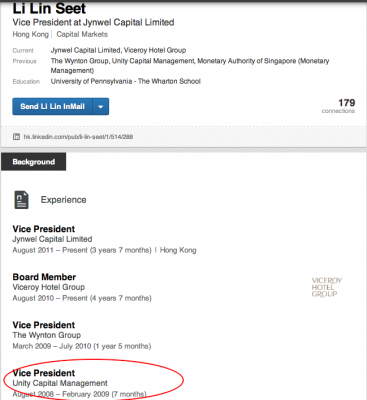

The Vice President of Unity Capital Management from August of that year was, according to his LinkedIn page, Jho Low’s long term business colleague Li Lin Seet.

Later, in July 2008, UBG made a massive new share issue in return for acquiring a company worth RM332million, according to its parent company CMS’s Annual Report of that year.

Those new shares were restricted entirely to one company buyer nominated by the seller (in contravention of stock market rules), making this new player an eventual 52.6% shareholder in the bank according to UBG’s later 2009 Annual Report.

The company concerned was Majestic Masterpiece, owned by a Middle Eastern consortium (called the Abu Dhabi-Kuwait-Malaysia Investment Corporation) represented by none other than Jho Low.

According to media reports, Jho Low at one point claimed he had a 10% stake in Majestic Masterpiece and the buy out gave him a place on the UBG board, alongside Taib’s son Mahmud Abu Bekir and son in law, Syed Ahmad Alwee Asree.

However, the 2009 Annual Report registered him as having a zero shareholding in the register of Director’s Interests.

It was widely known by this stage that the Taibs were strenuously looking for a buyer for the bank.

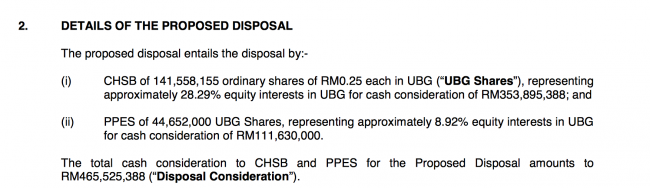

In fact, no less than three earlier deals had fallen through, when in January 2010 the Taib family parent company CMS announced that its subsidiaries had received an offer for their shares in UBG from PetroSaudi International for a total consideration of RM465,525,388 (USD$130million)

Given all the connections therefore, between Taib and Jho Low and the fact that PetroSaudi’s only other high profile involvement in Malaysia was its recent deal with 1MDB, into which the state development company had poured so much money, the questions by journalists such as those from the Star were not at all surprising.

However, PetroSaudi and Jho Low have all specifically and repeatedly denied that any of the money from the 1MDB joint venture deal was channelled into Taib’s UBG bank buy out.

The document trail that links 1MDB money to UBG

However, Sarawak Report’s analysis of thousands of emails and documents relating to PetroSaudi and 1MDB indicates that this was a company with very little cash base and few real assets with which it could buy out UBG.

A valuation of USD$2.9billion dollars, which had been presented to 1MDB in advance of the joint venture, was based mainly on a temporary negotiation with a Canadian company called Buried Hill, which had an unexplored oil field concession.

However, those negotiations fell through straight after the signing of the joint venture agreement.

Frantic negotiations during late August had enabled PetroSaudi to extend their options for a few more weeks till the end of September, at a total cost of just over $11 million – but the so-called Farmin agreement was terminated on October 4th, two days after 1MDB’s money was transferred into the Good Star account.

PetroSaudi and Buried Hill then entered into new negotiations over a possible merger of the two companies over the coming months.

However, by December the prominent British business figure, who had been brought in to act as Chairman of PetroSaudi, Rick Haythornewaite, was confirming that all negotiations had been called off.

“We have indeed broken off negotiations with BHE for good reason.” Haythornewaite informed a contact in December 2009.

This meant that in January, at the time of the offer for UBG, PetroSaudi could no longer claim the USD$2.9billion asset base it had boasted of in September to 1MDB.

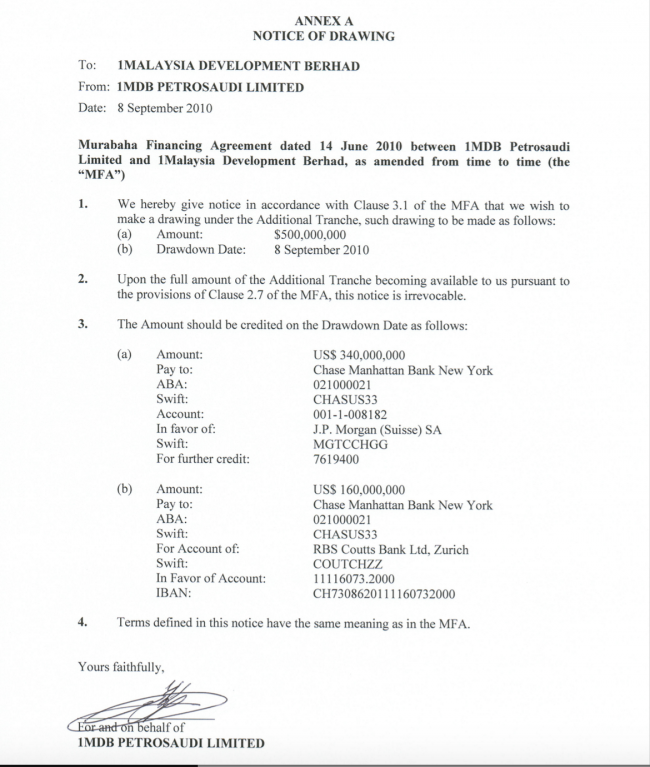

The company had received a working capital of USD$300 million from the deal with 1MDB and the documentation shows that at least two further tranches of USD$500 million were drawn from 1MDB later in July 2010 and September 2010 under the Murabaha Loan Agreement, which had been set up after the original Joint Venture was dissolved in March 2010 (a day before it would have been necessary to disclose the terms of the JV agreement including the $700 million “loan repayment” in the accounts).

Both of these further tranches from 1MDB were divided into separate bank accounts, giving USD$340 million to the PetroSaudi operating account with JP Morgan in Geneva and USD$160 million to the Good Star account with RBS Coutts in Zurich.

There seems to have been no attempt on these later occasions to explain the reason for the transfers to Good Star, in terms of a loan or anything else. But Shahrol Halmi signed the transfers on behalf of 1MDB, which was paying all the cash into the 1MDB PetroSaudi Joint Venture.

MURABAHA FINANCE AGREEMENT JUNE 14th 2010

Research by Sarawak Report has indicated that much of the working capital, which had passed under the control of the actual joint venture company, run by PetroSaudi from its new London base in Mayfair’s Curzon Street, was invested in new oil exploration and actual drilling.

Two drill boats were purchased for around a quarter of a million dollars, in order to exploit a new concession gained by the company in Venezuela.

So, the money to buy out UBG looks to have come from elsewhere and the evidence, in fact, shows very clearly how that the $700 million “loan repayment” was channeled into the company PetroSaudi International in the Seychelles, which eventually acted as the buyer for UBG.

How Tarek Obaid surrendered control of the USD$700 million loan repayment

A significant document indicates that back at the time of the signing of the 1MDB Joint Venture, September 29th 2009, the PetroSaudi Director Tarek Obaid specifically surrendered all rights to the so-called loan repayment to his company by 1MDB.

He signed a seemingly strange letter from PetroSaudi’s head office in the Caymans to PetroSaudi International Limited, PO Box 1239, Seychelles (naturally assumed to be a direct subsidiary) in which he declared:

“..we have directed the Company [1MDB PetroSaudi JV] to pay a sum of USD700 million (the “Transferred Amount”) to your account. We write to confirm that we shall have no rights, title or interest whatsoever in and to the Transferred Amount or any part thereof which shall be paid by the Company to PetroSaudi International Limited and we shall make no claims whatsoever in respect thereof (whether in respect of PetroSaudi International Limited or any of your affiliates) and we hereby expressly acknowledge that henceforth PetroSaudi International Limited is the only person entitled to the legal and equitable title and interest on and to the Transferred Amount which shall be paid by 1MDB PetroSaudi Limited to PetroSaudi International Limited pursuant to the abovesaid letter.”

OBAID LETTER TO PETROSAUDI SEYCHELLES

STRICTLY PRIVATE AND CONFIDENTIAL

The Board of Directors

PetroSaudi International Limited

P.O. Box 1239,

Offshore Incorporations Centre,

Victoria, Mahe,

Republic of Seychelles.Dear Sirs,

Loan Agreement dated 25 September 2009 between PetroSaudi Holdings (Cayman) Limited and 1MDB PetroSaudi Limited (the “Loan Agreement”)

We refer to our letter dated 29 September 2009 addressed to 1MDB PetroSaudi Limited (the “Company”) in respect of the above matter.

Pursuant to the said letter, we have directed the Company to pay a sum of USD700 million (the “Transferred Amount”) to your account. We write to confirm that we shall have no rights, title or interest whatsoever in and to the Transferred Amount or any part thereof which shall be paid by the Company to PetroSaudi International Limited and we shall make no claims whatsoever in respect thereof (whether in respect of PetroSaudi International Limited or any of your affiliates) and we hereby expressly acknowledge that henceforth PetroSaudi International Limited is the only person entitled to the legal and equitable title and interest on and to the Transferred Amount which shall be paid by 1MDB PetroSaudi Limited to PetroSaudi International Limited pursuant to the abovesaid letter.

Yours faithfully,

………………………………………

Tarek Obaid

Authorised Signatory

It might seem odd for a parent company to make such a commitment to a subsidiary.

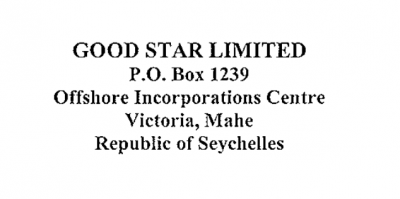

However, there was actually no evidence that such a subsidiary actually existed within the PetroSaudi group structure. Anyway, it is clear from the documents that in the first instance the $700 million was paid into an entirely different company, Good Star Limited.

Our researches indicate that there is no company by the name of PetroSaudi International Limited actually incorporated in the Seychelles, according to the islands’ official online corporation records.

Nor for that matter is Good Star Limited (which is in fact incorporated in the Cayman Islands) – however both these two companies do share the same mail box address PO Box 1239 at the Offshore Incorporations Centre in Mahe.

Panama Investment Manager

As demonstrated, the $700 million dollars over which Tarek Obaid had surrendered all rights, (followed by another $320 million in total) had in fact been sent to Good Star anyway, not PetroSaudi International Limited (Seychelles).

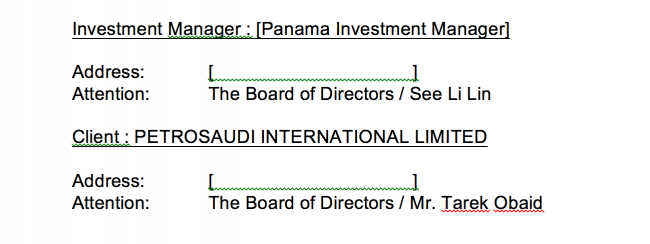

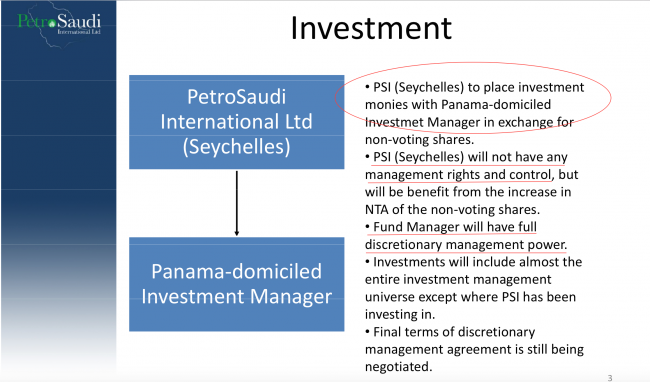

However, another interesting document, also drawn up by Jho Low’s legal assistant Tiffany Heah and sent to Patrick Mahony on 28th September, indicates that a sum of USD$610 million was indeed planned to make its eventual way into the PSI Seychelles company based at the same address as Good Star.

This document lays out an ‘Investment Management Agreement’ between PetroSaudi International Limited ‘incorporated in the Seychelles’ and Panama Investment Manager ‘incorporated in Panama’.

Under the agreement, PSI Limited agrees to surrender control over a sum of USD$610 million to Panama Investment Manager, allowing it to invest the money as it sees fit for a period of ten years.

Tarek Obaid signed the document on behalf of PSI Seychelles, which is described as a wholly owned subsidiary of PetroSaudi Holdings (Cayman) Limited (Company No.: MC-231027).

Signing for Panama Investment Manager was Jho Low’s side-kick Li Lin Seet, on behalf of the company’s board of directors.

This clearly secured control of the money by Jho Low, even though it was nominally being spent “via” PetroSaudi (Seychelles).

In short, PSI was acting as a front for Jho Low’s investments, just as Patrick Mahony had agreed on Day One. Crucially the contract spelt out:

During the continuance of its appointment hereunder, the Investment Manager….shall have full discretion to manage and to invest or divest the whole or part of the investments of the Client… as it deems fit.

For the initial investment, the Client shall subscribe for 610 million non-voting ordinary shares of USD1.00 each in the capital of the Manager

PANAMA INVESTMENT DOCUMENT – sent by Jho Low’s lawyers

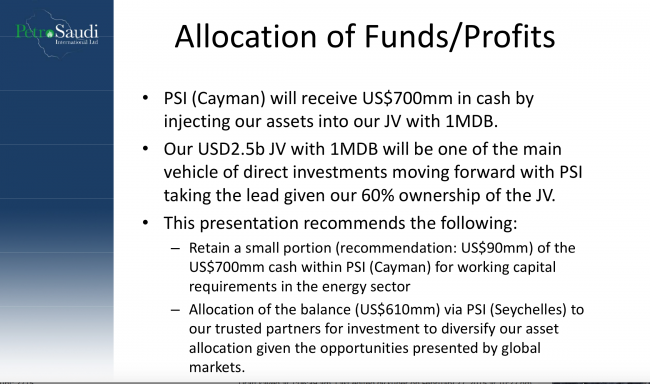

Further documents prepared in the rushed week leading up to the joint venture give all the evidence that could possibly be needed to confirm the suspicion that the money being controlled by Panama Investment Manager on behalf of PSI Seychelles emanated from the exact same USD$700 million payment due from 1MDB.

This is because Jho Low and his colleague Li Lin Seet had even prepared a power point entitled ‘Internal Presentation on The Use Of Funds” for PSI’s “Internal Management” to make the situation clear to their PSI colleagues.

The accompanying email exchanges reveal that the masterminds in New York wanted to make sure that their London based “front” operators could be in no doubt about what was going to be done with the money and who would control it:

Li Lin Seet sent the Power Point to PetroSaudi Managers on 28th of September one day in advance of the signing of the joint venture:

From: SEET Li Lin [mailto:[email protected]]

Sent: Monday, 28 September, 2009 1:23 AM

To: Patrick Mahony

Subject: Internal Presentation on Asset Allocation

The rest of the power point is self-explanatory:

Jho Low’s INTERNAL MANAGEMENT PRESENTATION ON FUNDS ALLOCATION

The full document explains in clear detail how $90 million ‘loan repayment’ provided by 1MDB would be retained for ‘expenses’, while the remaining $610 million would be placed in the hands of “trusted partners”, “via PSI (Seychelles)”.

That trusted partner, who had “full discretionary management power” over the money, was the company Panama Investment Manager, of whom the signatory was Jho Low’s trusted henchman Li Lin Seet.

However, in his emailed reply Mahony made clear that he found such an open declaration of the state of affairs to be unnecessarily indiscreet.

“I don’t think this is necessary, the Investment Management Agreement will suffice” he rapped out

To which Jho Low replied:

“No probs. Was just being extra careful to be sure”

FULL EMAIL EXCHANGE – PRESENTATION ON ASSET ALLOCATION

From: [email protected]

To: Patrick Mahony; SEET Li Lin

Date: Mon, 28 Sep 2009 03:36:00 0000

Subject: Re: Internal Presentation on Asset AllocationNo probs. Was just being extra careful to be sure. All good now I hear.

Sent via BlackBerry from T-Mobile

_____

From: Patrick Mahony

Date: Mon, 28 Sep 2009 05:35:12 0200

To: SEET Li Lin<[email protected]>

Subject: RE: Internal Presentation on Asset AllocationI don’t think this is necessary. The investment management agreement will suffice. Let’s discuss

From: SEET Li Lin [mailto:[email protected]]

Sent: Monday, 28 September, 2009 1:23 AM

To: Patrick Mahony

Subject: Internal Presentation on Asset AllocationResending due to mail error.

Since Panama Investment Manager was also a company controlled by Jho Low, through its signatory Li Lin Seet, this is confirmation that the money siphoned off from 1MDB was now in the hands of the tycoon pal of the PM, who had driven through the entire deal from start to finish.

No surprise?

The following January it was announced that the offer for UBG bank from PetroSaudi was being extended by its ‘subsidiary company’ based in the Seychelles, PetroSaudi International Limited.

Tarek Obaid signed the buy out in the capacity of Director of the company and it was announced to the world that this was a purchase by PetroSaudi and it had nothing to do with money siphoned out of 1MDB.

With the new available information this is a contention that is hard to sustain.

Journalists are therefore entitled to return and ask Jho Low and 1MDB their original question, whether it is not the case that the money employed in the UBG bank buy out was indeed a “bail out of CMSB” using public funds via 1MDB?

And had PetroSaudi not indeed acted out the role as “a front” for Jho Low, which at the very start of their negotiations on Sept 9th Director Patrick Mahony had written to agree the company would be “very happy with”?