Rumours are swirling that the Prime Minister is soon to produce his ‘Middle Eastern Donor’ for the secret US$680 million that went into his private account just before the last election.

Even his Deputy PM and Chair of UMNO had no knowledge of the money, but Najib says it was intended to be spent on the party and its election campaign – that it was “not for personal use”.

With no further details forthcoming on the matter the rest of the world has scant evidence beyond the word of the Prime Minister himself on these matters, which is hardly very satisfactory.

If UMNO was a properly handled sort of organisation, donations to the party would have instead have been recorded and the expenditures itemised.

There is also the small matter of election law, given there are limits on party spending, which have been exceeded several times over by this princely fortune that Najib secretly acquired.

Yet, Najib has shown himself irritated by the largely silent dismay with which much of the rank and file of UMNO have received the unfolding news of the way their leader chose to handle money allegedly given on their behalf.

Yesterday his rant was telling:

“What is happening is that they [UMNO rank and file] keep quiet when they get the money but when I’m being attacked, everyone keeps quiet,” [Najib Razak 8th August]

So, if someone purporting to be the “donor” is now dragged reluctantly into the limelight to get Najib off the hook will anyone be particularly impressed?

This money was not correctly nor legitimately handled and frankly, a statement that X or Y ‘donated it’ ought no longer be enough.

Time for Transparency

Transparency is the friend of the righteous and if Najib is so very innocent in this affair he and his ‘donor’ must go the whole hog – we should see all the transactions surrounding this ‘donation’ and then people may at last start to believe a man who has become famous for his changing stories over 1MDB.

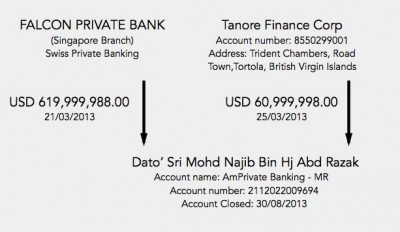

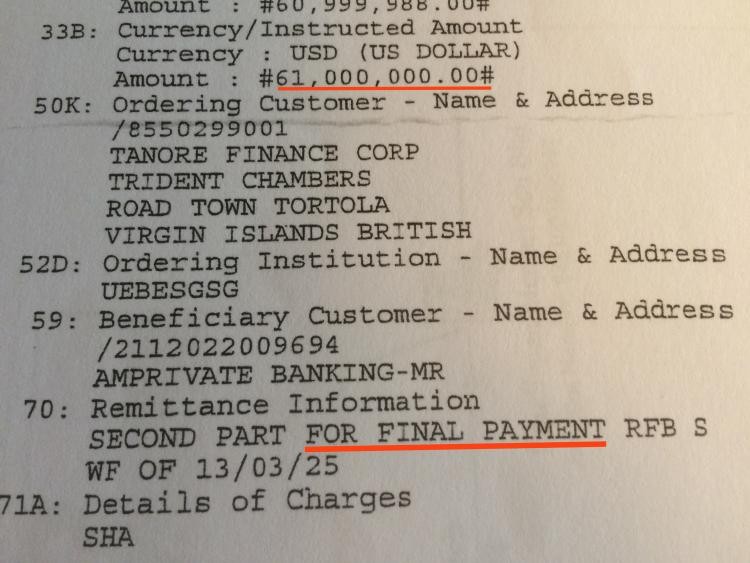

The ‘donor’, for a start, will need to confirm that he was indeed the account holder for Tanore Finance Corporation (BVI) at Falcon Bank in Singapore in March 2013.

This is something that can be checked by the regulatory authorities, of course, so best not to lie.

The ‘donor’ and indeed banks such as Wells Fargo ought also to explain why crucial information about the identity of the donor and the recipient were left off the transfer documents, which in fact described the transfer as a “payment”.

If the relevant banks, including Wells Fargo, failed to obtain and register this information they will have transgressed money laundering regulations – for a very serious amount of money indeed.

The Aabar Connection

Most importantly, there also needs to be transparency over the murky and distinctly related-looking money raising activities by 1MDB and Abu Dhabi’s Aabar fund, which so neatly coincided with this strange and as yet unsubstantiated ‘donation’ in 2013.

MDB’s ‘strategic joint venture’ signed with Aabar 12th March resulted in the raising of a US$3 billion bond by 1MDB just two days before the US$680 million started to arrive in Najib’s account.

If these were two entirely separate mega-transactions, then why not publish the details and settle the matter?

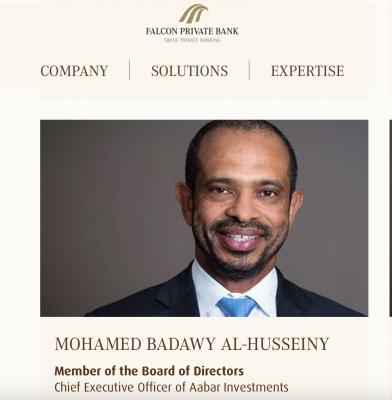

After all, it was Aabar’s own Chief Executive (and then Chairman of Falcon Bank) Mohammed Al-Husseiny, who was earlier brought out of the shadows, after many months of speculation, to acknowledge that it was he who stumped up the US$100 million investment in the production of Wolf of Wall Street for Najib’s step-son Riza.

Al-Husseiny (top) announced he had personally put his hand in his pocket to pay for the movie. It was a strange statement for a salaried civil servant to make and it was backed up by no evidence whatsoever.

It also signalled an apparent conflict of interest, owing to the numerous links between 1MDB’s borrowing activities and Aabar – links that have been shown to have been extremely lucrative for Aabar, although their role has been almost entirely passive on the investment side into 1MDB.

These are issues only proper transparency can resolve.

1MDB’s 2014 accounts and problems for Goldman Sachs

1MDB’s accounts dealing with this period are for the year ending March 2014.

Produced by Deloitte these are sorely lacking in detail, but they do confirm that a sum of US$3 billion was raised by the 1MDB subsidiary Global Investments Limited (IMGIL) as ‘seed capital’ for a joint venture project with Aabar called Abu Dhabi Malaysia Investment Company (ADMIC).

This was Malaysia’s contribution to the much touted ‘strategic partnership‘ signed March 12th 2013 between 1MDB and Aabar to develop the proposed ‘Tun Razak Exchange’.

In the end Aabar did not contribute.

The money was raised privately in just one week by the bank Goldman Sachs International (GSI) according to these accounts, which record that the money had been raised by March 19th.

GSI had also earlier raised two other power purchase bonds for 1MDB, which were for unexplained reasons co-guaranteed by Aabar (a matter only discovered once confidential copies of the private bond issues were leaked).

Altogether the bank raised US$6.5 billion in borrowing for Najib, charging a staggering US$590 million.

Firstly, it tells us that half of the entire US$3 billion raised on 19th March 2014, purportedly to fund the building of the Tun Razak Exchange had been spent by the end of the accounting period!

It was not spent on the project (we all know that is still a wasteland) but, according to the Accounts US$1.58 billion was banked, but “the remaining net proceeds [$1.42 billion]” was “utilised by the Company for working capital and debt repayment purposes” i.e. used up for nothing!

Given that this is an enormous sum for an investment company to have effectively wasted in the course of only one year (roughly double the sum that ended up in Najib’s account in fact) aren’t the public entitled to a few more details?

Surely, the Prime Minster ought have no qualms about detailing exactly what happened to all this public borrowing, given it was authorised by 1MDB’s sole ‘shareholder’ (himself) and guaranteed by a ‘letter of comfort’ by the Minister of Finance (himself again)?

Najib ought to be anxious to put any concerns to rest that some of this vast leakage could have ended up funding his anonymous Middle Eastern ‘donor’, for example.

What was Aabar’s role in the strategic partnership at TRX?

The 2014 Annual Report goes on to give some further teasing indications about the management of this bond organised by Goldman Sachs (GSI).

Because although the only money actually raised for the project came from Malaysia’s 1MDB, Aabar seems none the less to have been accorded a joint venture partner status in the development project.

This was signalled when the announcements were made during the signing on 12th March. But, given Aabar’s lack of actual investment, the question is why?

Isn’t it time the deal that was signed between Aabar and 1MDB that day was therefore made public, in order that Malaysians can understand exactly what it is that the boys from Abu Dhabi brought to the party?

We do after all now know, thanks to a leaked copy of Goldman’s bond issue to Sarawak Report (now banned in Malaysia) and research by the business paper The Edge (now banned in Malaysia) that Aabar made a fortune as a co-guarantor of Malaysia’s separate power purchase agreement bonds (totalling US$3.5 billion).

The Edge has calculated that Aabar could have extracted up to a billion dollars out of the deal, thanks to the options it acquired in its unexplained capacity as co-guarantor.

Goldman Sachs who brokered the unusual deal made a jaw dropping level of commission themselves, for reasons unexplained.

So, did Aabar also stand to benefit from a portion of the US$3 billion raised by the IMGIL bond, according to the March 12th agreement – and by any chance did that portion end up being channelled by Goldman Sachs International into Aabar’s own Falcon Bank?

Relations will doubtless have been smoothed with Falcon Bank by the fact that the company’s Swiss CEO and Swiss CFO at the tome had both themselves formerly worked in senior positions at Goldman Sachs itself.

It was from Falcon Bank, of course, that the very generous donor sent Najib Razak that US$680 million just two days after Goldman delivered on the bond money.

As for Goldman Sachs, the bank has answered questions about the equally jaw dropping levels of commission that it extracted from this particular deal, by explaining the ‘client‘ (Najib) was in a hurry to get the money and therefore the bank took over a section of the risk, in return for an added incentive payment (calculated to be around 9%).

What was the hurry that caused the Malaysian public purse to have to cough up so much interest Najib?

People will be left thinking that the looming election deadline was a factor, unless these matters are cleared up fast.

Just give us the facts

Najib Razak can not complain about such lines of speculation when after months of scandal over missing billions, during which time this secret payment to himself emerged, he has failed to come up with any convincing explanations.

Neither has 1MDB given anything approximating a clear enough account of how so much of its borrowed money has been spent on “working capital” and “debt repayments”.

Najib’s key banking partner in all this activity has certainly started to feel the heat. It emerged today that Goldman Sachs’ KL office was raided by investigators from the now neutered MACC on the same day, July 8th, they raided the offices of 1MDB.

Clearly these investigators had also concluded there might just be a connection between the bonds they raised and malfeasance at 1MDB.

Najib’s subsequent lash back – a combination of raids, arrests, transfers and denials directed at bringing this MACC investigation to a sharp close – hardly brings confidence. The international press and regulators are now looking far more closely at this major international deal involving one of America’s largest banks.

Already Singapore has frozen two relevant accounts at Aabar owned Falcon Bank (including that of Tanore Finance Corporation, who sent Najib the cash) and five accounts have also been frozen by the central regulators in KL.

Beyond that, the United States regulators will have available all the details they might need on these dollar transactions to get to the bottom of who sent what money where. According to the news agency Reuters today:

The scandal is exactly the sort of thing Goldman has been trying to avoid since overhauling its approval process for transactions in the wake of the 2008-09 financial crisis.

Banks typically put increased scrutiny on deals where there may be reputational risk as well as financial risk, such as when dealing with governments and tycoons.

“Goldman should be the first to realize that if something seems to be too good to be true and the fees are that high, they should look for a problem,” said Nell Minow, vice chair of ValueEdge Advisors, which provides corporate governance advice to institutional investors. “They have some real risk here.” [Reuters 9th August 2015]

So, would it not be better for Najib to just pre-empt all this and prove his and 1MDB’s innocent role by appropriate transparency, which has been so glaringly absent so far?

This is the politician who in 2012 announced that all parties should be transparent over their funding, but who is now asking the opposition parties to lead first by example. Why can’t this man stop changing his stories and just lay down the truth?