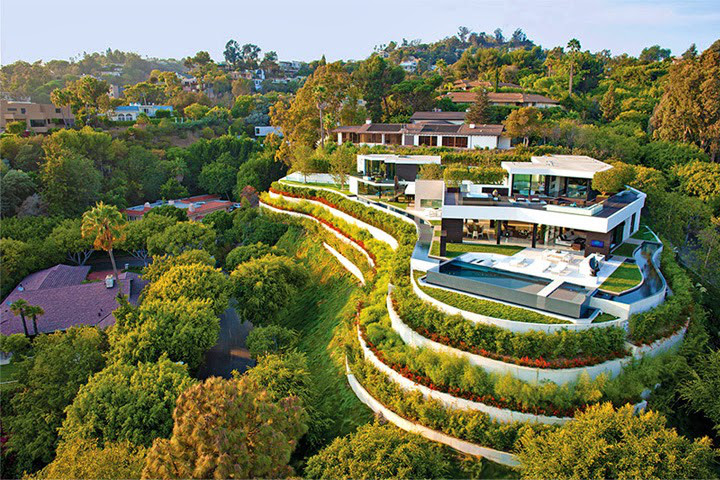

The most expensive mansion in Beverley Hills (reputedly) glitters with glass atop a cascading hillside of manicured terraced lawns – its projected price tag is around US$45 million plus.

According to court depositions, however, a recent Arab guest at the property was unimpressed by a temporary lack of hot water in the Palumbo designed futurist fantasy, which has sparked a revealing row about its ownership.

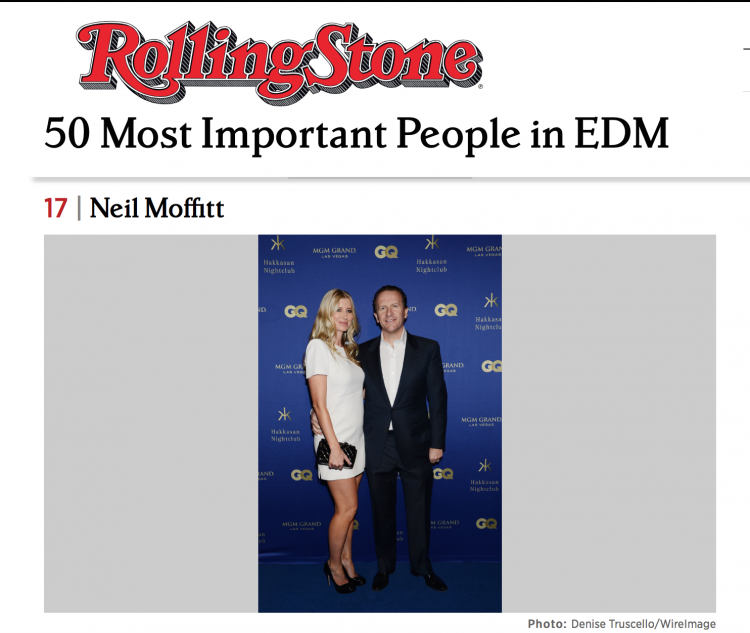

When the house changed hands last year (following a total rebuild by top designer Michael Palumbo) the cash buyer was announced to have been a British born ‘nightclub mogul’ named Neil Moffitt. However, this was questioned.

Commentators at the time referred to raised eyebrows that even a man with the reported income of Mr Moffitt (it had just been announced he had sold his company Angel Management to the Hakkasan nightclub chain for some US$100 million) could have afforded such an expensive property.

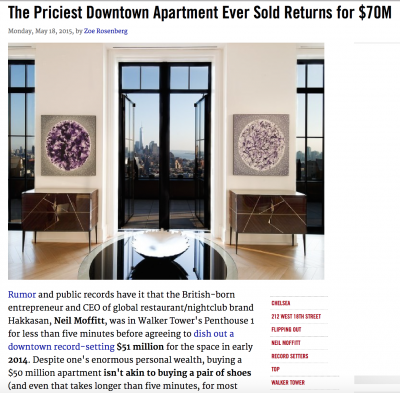

After all, this was pretty much at the same time as he was also being identified as the buyer of yet another record breaking purchase, a US$50 million penthouse flat (now up for re-sale for US$70 million) in the Walker Building in New York.

So was he the real buyer?

Moffitt, according to our researches, has had a checkered career as an ‘impresario’, since starting out as a bar owner in his native Stratford upon Avon before gravitating to Las Vegas.

In 2009 he was broke, say insiders, following the closure of the Vegas club he was managing by the name of ICE.

He was forced to sell up his dance music company by the name of Godskitchen, in order to fund a divorce from his British wife.

But, some point in the following year he struck a lucrative encounter with a man of apparent enormous means, whose obsession with nightclubs had seen him perhaps inevitably gravitate to Moffitt’s current corner of the globe.

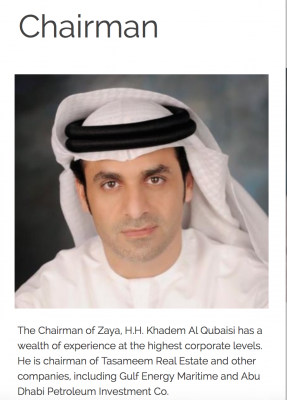

This was Khadem al Qubaisi, who was soon to also link up with Malaysia’s most controversial businessman Jho Low both in business and on the nightclub scene:

“Moffitt was like a lousy shark hanging around looking for rich fools and both Khadem and Jho Low floated in around the same time – Moffitt netted them both and the rest is history” was how one Vegas insider observed the situation to Sarawak Report.

“All the stories about KAQ [Khadem Al Qubaisi] not being happy he did not get the table he wanted in Wynns is a load of rubbish, simply Moffitt used his usual gift of trying to find money explaining Vegas could be taken. KAQ jumped at the opportunity and today we see why” .

Referring to Jho Low’s own arrival on the Las Vegas nightclub scene sometime later in 2010 the same observer reflects:

“Did Moffitt introduce KAQ to Low? I would bet 99% on this, as Moffitt liked to play the matchmaker and the more wealthy people he knew made himself look bigger. KAQ and Low like the girls and everything around it, Moffitt had seen the weakness in KAQ and pushed him into having his own clubs. KAQ was a sort of very rich nobody in Las Vegas until Moffitt promoted him through Hakkasan – then the girls were non stop. Low same thing as KAQ – ugly but with deep pockets – they are now like the three best friends on the planet.”

This is an account that contrasts with the stellar trajectory now being presented to the press to explain Moffitt’s sudden big bang arrival as a top player in the US entertainment scene.

However, it provides a compelling explanation for Moffitt’s sudden transformation into one of the biggest investors in America.

With respect to the Beverley Hills mansion, it is the designer Michael Palumbo himself who has cemented allegations that the real buyer of 1201 Laurel Way was indeed Khadem Al Qubaisi, the ex-Abu Dhabi sovereign wealth fund manager and Moffitt’s later Hakkasan, confirming him as the source of the mega-money behind Moffitt.

The papers submitted in Palumbo’s court case against Moffitt, which is due to be heard in the California Central District Court early in October, provide some fascinating insights into the relationship between Moffitt and ‘KAQ’ and also into Al Qubaisi’s perceived level of wealth.

Khadem, after all, was only a salaried official at Aabar and IPIC, the wealth funds from which he was sacked earlier this year, which raises considerable questions as to how he himself became so phenomenally rich.

According to Palumbo’s court deposition, the Arab guest who had suffered the disturbing episode without hot water at 1201 Laurel Way, was a fellow by the name of Darwish, described as Khadem al Qubaisi’s brother.

The matter had apparently filled Mr Al Qubaisi with shame, given the huge expense of the property:

“Mike, [wrote Moffitt in February 2015]…. As you know KAQ was very annoyed at the ongoing situation at 1201 Laurel Way .. on a recent visit from his brother there were many issues with the property not limited to a land slip and lack of water, which led to a very embarrassing situation for both he and I when his brother returned to Abu Dhabi. Clearly this was not what was expected when purchasing a 31 Million Dollar property… As I stated to you KAQ became so disenchanted by the combination of circumstances he no longer wanted his company to be involved in this project or with your future development efforts” [letter cited in the current fraud case against Moffitt relating to a second property, 1169 Hillcrest, Beverley Hills.]

According to Palumbo, Moffitt used this incident as an excuse to break an agreement over a later separate development, in order to wrest control of a multi-million dollar property (1169 Hillcrest) from the designer, who is now prosecuting him for fraud.

Palumbo’s deposition describes Moffitt as:

“.. a wealthy British-born businessman and Chief Executive Officer of the Hakkasan Group. Upon information and belief, Moffitt acts as an agent and/or intermediary in the United States for certain wealthy Arab investors, including Khadem Al Qubaisi, Chairman of the Hakkasan Group…. Moffitt told Palumbo that if he partnered with ‘His Excellency’ [Khadem al Qubaisi] who has an estimated net worth of billions, Palumbo would “never need to look for money again”

It appears therefore that the money behind Moffitt is established as being Al Qubaisi’s in this case.

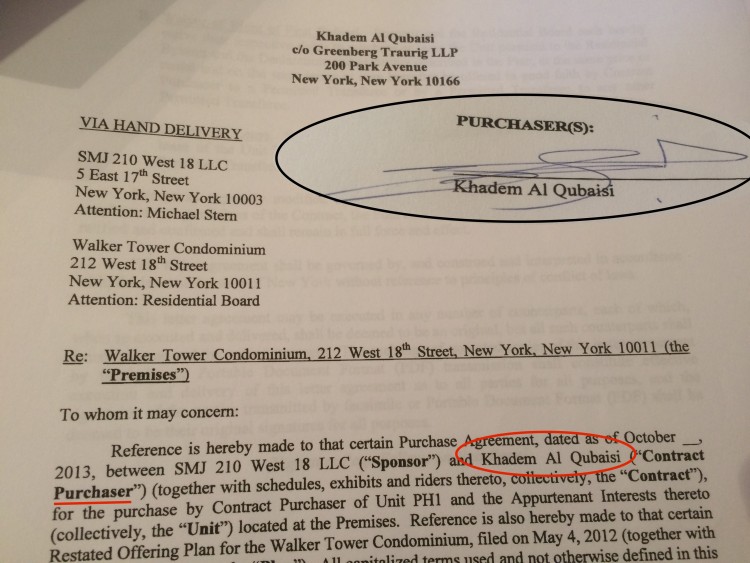

Likewise with the purchase of the Walker Tower Penthouse, where Sarawak Report has already previously identified Al Qubaisi as the actual buyer.

Documents examined by us reveal that the transaction was negotiated through Khadem Al Qubaisi’s Luxembourg bank manager Marc Abroisien of Edmond de Rothschild Banque Privee, on behalf of an off-shore vehicle named Vasco Investment Services S.A., which is owned by KAQ and based in the British Virgin Islands.

The law firm which negotiated the penthouse purchase was New York’s Greenberg Traurig, which holds several connections with both Al Qubaisi and Jho Low’s various business ventures and other interests.

No wonder real estate agents were left gasping after Moffitt agreed to sign on the deal after a five minute visit – he was just the front.

Sovereign wealth?

However, the profile of Mr Al Qubaisi as some form of royal ‘His Excellency’ from the Emirates worth billions of dollars is also troubling, given his actual status in the Emirate of Abu Dhabi.

He is in fact a commoner and was a salaried official working in very senior positions in the International Petroleum Investment Company, Aabar and their various subsidiaries.

Aabar lost billions under Al Qubaisi’s management, experiencing a drop in its base capital from over US$70 billion to under US$15 billion in that period, which hardly suggests special bonuses on performance.

Yet, Mr Al Qubaisi nevertheless clearly numbers amongst the global super-rich, as evidenced by his personal property purchases and ostentatious spending.

He has also been pouring hundreds of millions into private businesses, which continue to operate separately from Aabar and IPIC, from which he has now been sacked.

In the United States these businesses number most notably the company Tamaseem Real Estate Limited (Abu Dhabi) which directly owns the nightclub and restaurant chain Hakkasan, of which Al Qubaisi is Chairman.

Wow Hakkasan!

Hakkasan’s expenditures and expansion over the past two years have taken the entertainment industry by storm and turned into fast moving global phenomenon, with Neil Moffitt at the helm as Chief Executive and PR front man.

The level of investment and expansion has been nothing short of seismic, projecting Mr Moffitt into the front line of the US entertainment industry’s line up of ‘power players‘.

Over the past three years Moffitt as the Chief Executive of Hakkasan has rolled out an astonishing series of bars and restaurants world wide. The Chairman of the enterprise and also Chairman of its registered owner Tasameem Real Estate LLC has been Khadem Al Qubaisi.

The sums involved been phenomenal, with the Hakkasan nightclub opened on the re-vamped Studio 54 site in Las Vegas in 2013 rated as the most expensive ever built.

This was followed by a string of Las Vegas venues including Wet Republic, Stingaree, HQ Nightclub, HQ Beach Club, and Omnia, which hosted a massive opening event at the original Caesars Palace venue in January, itself a once favoured haunt of Jho Low.

The investment has continued with clubs in LA and across the world – Moffitt has declared to newspapers that he plans 15 mega-clubs to open internationally, causing other nightclub entrepreneurs to whisper that they fear a strategy to put the rest of them out of business.

A parallel restaurant chain has also rolled out across the US and beyond and the brand is now extending into a global portfolio of luxury hotels – all mega investments since the crash period of 2010.

And the spending has not been restricted to venues – much of the gossip around Hakkasan has been on the subject of the eye-popping fees being paid by the group to its ‘cult’ DJs, whom it alleges are the terrific draw bringing custom into their clubs.

A record spinner named Calvin Harris, who happens to be an old friend of Moffitt, has been signed up for a reported $400,000 a night to perform at the Omnia Club, forming just one of a team of DJs who are being paid what would appear to be unnecessarily enormous fees for the skill set involved.

The names include promoted ‘icons’ such Afrojack, Chuckie, Oliver Heldens, Nicky Romero and Showtek, all paid astonishing sums.

The question on several lips therefore is why is the chain relaxed about paying so much more than it logically needs to for such services – in other words who are the shareholders behind the nightclub industry’s biggest splash in years and why are they so keen on flushing their money through these clubs?

Tasameem

Moffitt has proved highly non-committal on the matter of who owns the company which owns Hakkasan and its related businesses. According to the UK Telegraph:

He is cagey about Hakkasan’s financiers, however. When pressed for details of shareholders or any of the company’s recent fundraising activities, he simply says: “Hakkasan is a private company based out of Abu Dhabi,” although he does say that he has skin in the game himself. “I’m very invested in the business.” [Telegraph Dec 2014]

There is of course the widespread legend about how one of Abu Dhabi’s royal figures Sheikh Mansour (owner of Man City) enjoyed a Chinese meal at the original Hakkasan restaurant in London’s fashionable Knightsbridge and promptly bought out the restaurant and launched the brand.

Mansour was Khaddem’s boss as the Chairman of the International Petroleum Investment Fund and is popularly understood to have been the big money behind parallel private enterprises also headed by Al Qubaisi.

However, Chinese cuisine in Knightsbridge is one thing. The bare flesh, booze and bawdiness of the nightclub scene in the world’s premiere gambling capital Las Vegas is quite another.

Has a member of Abu Dhabi’s conservative ruling family really sponsored this mass investment in ‘Sin City’ and beyond?

Or is Tasameem a more personal enterprise on the part of the club-addicted KAQ, whose double life we revealed shortly before his retirement from the sovereign wealth business earlier this year?

If so, how did Mr Al Qubaisi come to amass so much personal wealth?

Sultan of San Trop

There seems little doubt that much of the conspicuous consumption by KAQ is indeed entirely personal.

Not only are the properties in the US indicative, but our research has unearthed an extraordinary accumulation of wealth and assets also across Europe, most particularly in his favoured watering hole in the South of France, home to the favourite discotheques and yachting marinas of the super-rich.

Al Qubaisi is a famed fixture of the party scene in the Cote d’Azure and San Tropez with a string of properties in the region and also apartments in Paris.

His fleet of fast cars, including two Bugatti’s emblazoned with his personal brand of KAQ hang outside his pad at Boulevard Croisette in Cannes.

Property companies in France, lined up under the names of SCI KAQ 1, SCI KAQ 2, 3, 4, and 5 also represent his ownership of several high-end apartments in Av Vaquerie, Av Montaigne, Av Lena, E. Reclus and Val de Pons in Paris.

Our researches indicate that a number of other companies under his encompassing VASCO Trust own a Formula One car, a jet, an interest in one of the world’s larges yachts (Topaz) and various other items of real estate interests in Spain and elsewhere, all managed by his bankers Edmond de Rothschild, Luxembourg.

Khadem’s conspicuous wealth in France has given him apparent clout in the highest circles, according to our information, with rumours of an influential relationship with the former president and now once again presidential candidate Nicolas Sarkozy.

Just last February, before Al Qubaisi was removed from his posts in Abu Dhabi, Sarkozy caused anger amongst party supporters in France by flying to UAE during a critical political moment, in order to attend an IPIC meeting headed by Al Qubaisi.

Sarkozy was alleged by the press to have been well-paid for his pains and with politicians looking for financial backers for the up-coming election, Al Qubaisi is clearly regarded as a man with powerful connections in France.

More on the Tasameem mystery

With regard to the source of such spending power, Sarawak Report has researched further interesting evidence.

According to documents accessed by this site, Qubaisi’s private Luxembourg bank, Edmond de Rothschild, has specified him to be the “sole ultimate beneficial owner” of a number of off-shore legal entities managed by them.

The list includes a company named Tasameen (sic) Investment SA in the BVI.

This revelation begs the question whether this off-shore company might in fact be the ultimate beneficial owner of the Abu Dhabi owner of the Hakkasan chain, because a strange tangle of names has only caused further confusion about this matter which Moffitt has been so reluctant to clarify.

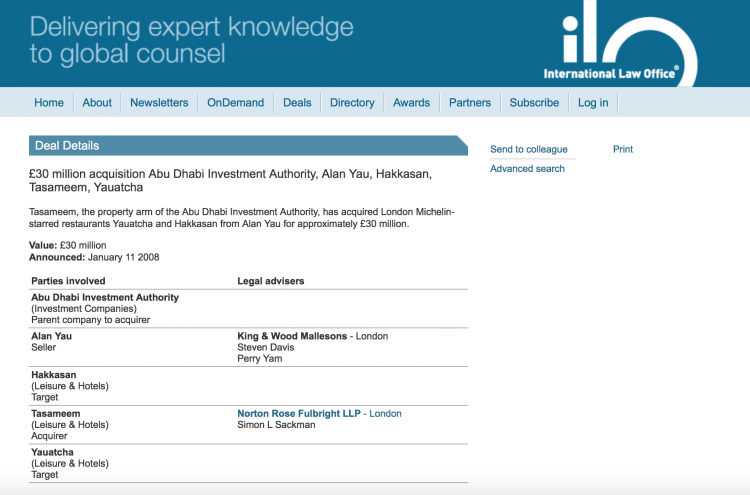

After all, when the London based Hakkasan restaurant was originally bought up to launch the brand in 2008, reports indicated that, far from being a private investment by Sheikh Mansour or anyone else, this was a purchase by the Abu Dhabi government owned Investment Authority ADIA, through its known property arm ‘Tasameem’:

Tasameem is indeed registered as a property investment subsidiary of ADIA, however Hakkasan does not appear to number amongst its listed acquisitions.

Research shows on the other hand that there is an entirely separate private company in Abu Dhabi operating under the very similar name of Tasameem Real Estate LLC, which although it is closely connected to Khadem Al Qubaisi (who is the Chairman) has no link whatsoever with ADIA or any of Abu Dhabi’s sovereign wealth funds, such as Aabar or IPIC.

Tasameem Real Estate LLI is an extremely big player in terms of investment in the gulf and it is clear that this is the company which owns Hakkasan and not the ADIA sovereign wealth fund, as was misleadingly understood to be the case.

It is a distinction that the Hakkasan chain’s own website makes abundantly clear:

“Hakkasan Group is owned by Tasameem Real Estate LLC, an Abu Dhabi-based investment company”. [Hakkasan website]

We therefore ask is this company chaired by Khadem Al Qubaisi in any part a subsidiary of the BVI company Tasameen Investment SA owned by Khadem Al Qubaisi, or is it owned in any part by Sheikh Mansour who is widely considered to be the ‘real money’ behind Khadem’s private ventures?

The answer can in fact be found thanks to a Tampa Florida court case (see below).

Still big in the Gulf

Tasameem Real Estate LLC has meanwhile developed considerable parallel shared interests with Aabar and IPIC over the period in which Al Qubaisi managed all three companies.

These interests in many cases still remain, as does Khadem’s private role in a number of major concerns identified in the Gulf by Sarawak Report.

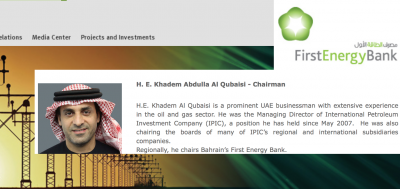

For example, Al Quabaisi remains a key player in at least two private banks.

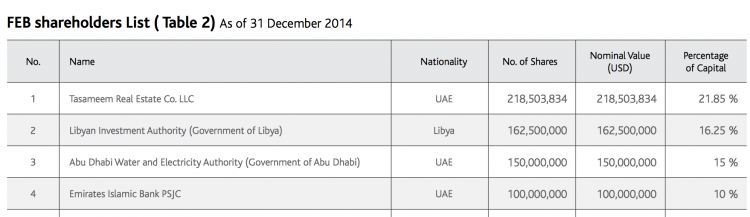

He is Chairman of Bharain’s First Energy Bank (started 2012), whose largest shareholder is again Tasameem Real Estate Company LLC.

And he is also the second largest shareholder at the Alizz Islamic Bank in Oman (also founded in 2012) in which he holds a personal 15% shareholder stake after none other that the sovereign wealth fund he chaired Aabar (30% stake) and again First Energy Bank (15% stake).

In a separate venture Tasameem Real Estate made major investments in the private jet company Xojet in 2008, only to see Aabar take over as the major investor in 2010.

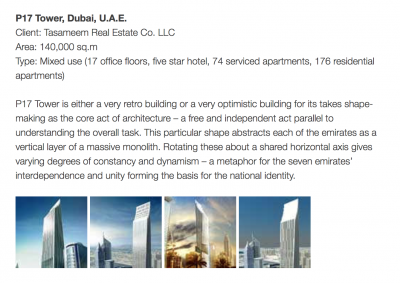

The P17 Tower in Dubai was commissioned by Tasameem Real Estate, which then hired Arabtec owned by Aabar to build it.

These businesses alone indicate a tangled overlap between investments by the sovereign funds, which Al Qubaisi was tasked with managing through the State on behalf of his IPIC Chariman Sheikh Mansour and his private interests through companies like Tasameem.

Front for Sheikh Mansour?

The assumption has always been therefore that Khadem Al Qubaisi has been managing Mansour’s private investments alongside managing the public funds he is responsible for and that the money was not his in either case.

Yet, there is solid evidence that at least some of his major private ventures have been on his own initiative, which goes a considerable way towards explaining Al Qubaisi’s private wealth.

Earlier this week, for example, Sarawak Report reported how a European court battle, relating to the ownership of Madrid’s Santander Bank Building, has revealed a similar tangle of public and private Al Qubaisi interests, with the Aabar fund posing as the major and exposed shareholder in a loan venture in which Al Qubaisi had also taken a secret private stake.

Meanwhile, a separate court case in Tampa, Florida has also revealed the true ownership of Hakkasan’s parent company Tasameem Real Estate Investment.

How a Florida case outed KAQ

The case, which was brought by an investment broker Capital Trans International (CTI) against IPIC, Aabar and Tasameem Real Estate Investment in 2013, cited Khadem Al Qubaisi as the responsible party controlling all three companies – two of them public wealth funds and the third entirely private:

Tasameem [Real Estate LLC] is private limited liability company organized under the laws of Abu Dhabi and has its principal place of business there. The government of Abu Dhabi had no role in the formation of Tasameem.”

“The Defendants [IPIC, Aabar and Tasameem] are tied together by their shared leadership found in Mr. Khadem Al Qubaisi.” [Florida Middle Court]

Much of the subsequent court battle (which was eventually dismissed as being outside of Florida jurisdiction) then focused on CTI’s insistence on knowing who were the beneficial owners of Tasameem Real Estate LLC in the face of Al Qubaisi’s reluctance to provide that information.

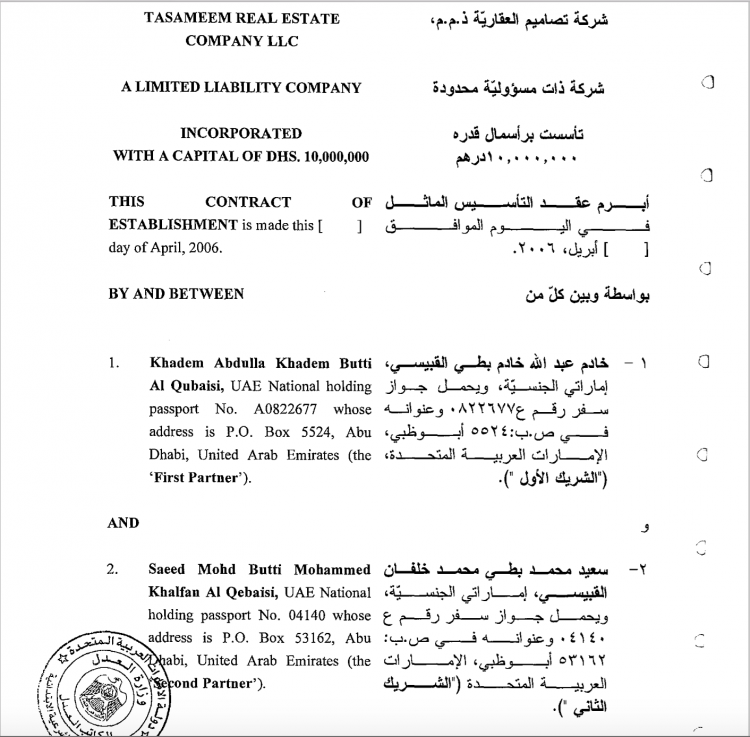

The court eventually commanded that the ownership documents should be produced, revealing none other than Khadem Al Qubaisi himself and a partner by the name of Saeed Mohd Butti Khalfan Al Qebaisi, an apparent relative, as the two partners behind the company.

There is no reference to Sheikh Mansour, which dispels all rumours that the big money behind the Vegas nightclub boom belongs to him!

However, this confirmation of his direct ownership of the Haakasan chain intensifies the mystery as to how Qubaisi, who is now with Jho Low at the centre of Malaysia’s 1MDB/ IPIC missing money mystery, got to be so extremely rich?

Barclays deal began the rise to riches?

According to researches by Sarawak Report Khadem’s first steps into the category of personal super-wealth took place as a result of the highly controversial Barclays rescue deal conducted during the 2008 financial crash.

The British bank was trying to avoid a government bail out and sold shares worth £3.5 billion apparently to Sheikh Mansour.

The deal was orchestrated by a close personal friend of Khadem Al Qubaisi of the time, Amanda Staverley – he was then CEO of IPIC with Chairman Sheikh Mansour as his boss.

There has been considerable confusion as to whether it was Mansour or IPIC which actually put up the intial risk with the investment. However, in the outcome it was stated that the investor was not IPIC (as had originally been reported by Barclays) but Mansour, who then profited personally to the tune of £3.1 billion on re-selling the shares a few months later.

“Khadem became the golden boy after the Barclays deal and nobody could question him” observes one Middle East writer, “but look at all his subsequent investments at Aabar, they were all boys toys [cars, jets, space ventures] and they lost a lot of money”

The Barclays deal, which was managed by Staveley and Al Qubaisi, has been subjected to investigation by the UK serious fraud office, not only with regard to the reporting irregularities but also the complaint by shareholders that an enormous and unusual commission of £110 million had also been written into the deal to be paid upfront to the investor, nominally Sheikh Mansour.

There appeared to be no reason to write this commission into an already highly profitable opportunity for the Sheikh.

Investigations, by the magazine Euromoney have subsequently shown however that the shares in Barclays were in fact held by a series of off shore companies, PCP Gulf Invest 1, 2 and 3 that had been incorporated by Staverley and then placed under the sole ownership of Khadem al Qubaisi’s own company KAQ Holdings.

Euromoney also concludes from the documents that all of the questionable £110 million ‘commission’ on the deal was “divided up on a rough-and-ready basis between Sheikh Mansour’s associates and advisers… Staveley; Khadem Al Qubaisi; Al Jassim; and one Said” managed under the control of Al Qubaisi’s company.

Gulf observers have told Sarawak Report that this apparent windfall produced the first sign that KAQ had started to obtain real wealth.

However, that it was later in 2012 that the wealth fund manager started spending really serious money on properties and nightclubs.

Investigators looking into the huge sums of money that went missing from the 1MDB/ Aabar bond deals between 2012 and 2013 and how Aabar and IPIC’s various loss making ventures may have tied in with private deals orchestrated by Khadem, may eventually shed light for those seeking to understand how it can be that Mr Moffitt’s spending spree in the global entertainment business ultimately appears to be funded by Khadem Al Qubaisi.