Documents released by Sarawak Report led DAP Finance Spokesperson Tony Pua to state yesterday that he suspects that much of the money paid by 1MDB in 2014 to the bogus Aabar Limited BVI company was in fact circulated back through 1MDB’s Brazen Sky bank account in Singapore, in an attempt to con Parliament and the auditors that cash had been “redeemed” from the so-called Special Purpose Vehicle (SPV), which had allegedly invested US$2.3 billion in the Cayman Islands.

“it occurred to me that the 1MDB Financial Statements for the year ending 31 March 2014 were signed off by the auditors, Deloitte coincidentally on 4 November 2014, when 1MDB GIL also made a payment of US$222 million to Aabar (BVI).” says Pua.

“At that point in time, there was increasing concern over 1MDB’s US$2.318 billion investment in an obscure investment fund based in Cayman Islands. The Board of Directors minutes have shown that the Management were repeatedly instructed to redeem the investment and repatriate the proceeds back to Malaysia throughout 2014. The company was under immense pressure because the authenticity of the investment was being publicly questioned…. The accounts were finally signed off by Deloitte when 1MDB was able to “show” the auditors that US$1.22 billion have been redeemed. The money was however, not repatriated to Malaysia.”

It is a shocking suggestion, because it would mean that two Swiss banks, BSI and UBS, would have been involved in helping shift these suspicious transactions through their Singapore branches – in some cases turning round hundreds of millions of dollars in one day, according to the figures. This is because BSI managed the Brazen Sky account and UBS managed the bogus Aabar Limited account.

Chapter 2 Item 8 of the AG Report confirms suspicious nature of SPV transactions

The Auditor General’s own analysis of this alleged ‘redeeming’ and ‘repatriation’ of the SPV cash (see full excerpt beneath) and the figures in his report lend weight to Pua’s suspicions, even though the AG complains he cannot reach a solid conclusion on the matter, because of the incomplete and limited information provided to him by the company.

“JAN [Audit Dept] was unable to verify 1MDB GIL’s subsequent payments or how the funds redeemed from the (SPC portfolio) funds were used because important documents such as bank statements and payment vouchers were not handed by 1MDB for JAN’s verification despite five requests being made between May and October 2015. Documents such as bank statements should be readily available to bank clients.” [8.12]

Such criminal obstruction of its own ought to demand severe action against managers, whom the Public Accounts Committee have called for the police to investigate.

What emerges from Chapter 2 item 8 on the Cayman SPV and supposed repatriation of the cash is yet again a litany of appalling bad practice at 1MDB, changing stories and missing money. The Auditor General officially confirms what critics have long suspected, which is that 1MDB serially lied to parliament and the public and utterly failed in its duty:

“The issues that were uncovered depict a company which had made unwise business decisions, took high risks and was not in line with 1MDB’s status as a Government-owned strategic development company to help develop the country.”[8.29] the Auditor General angrily concludes.

‘Round-Tripping’?

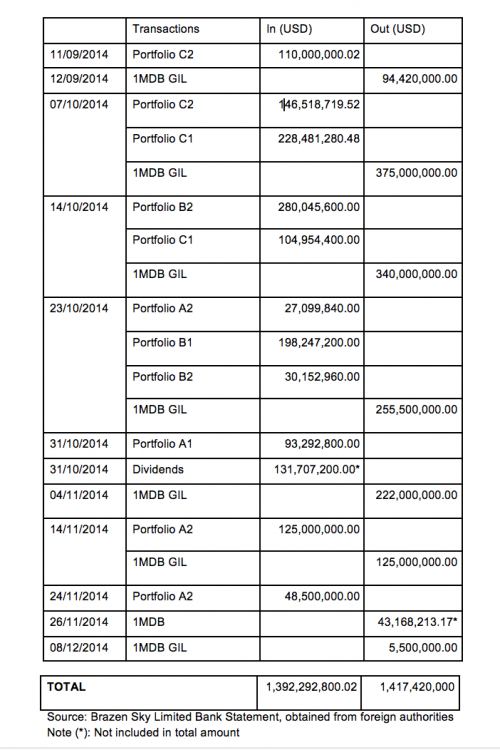

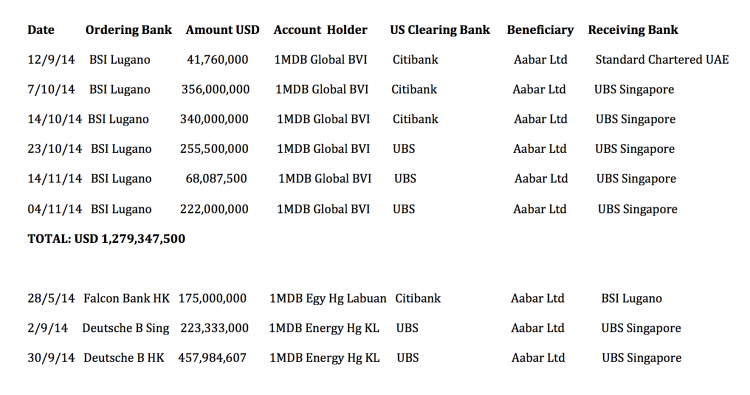

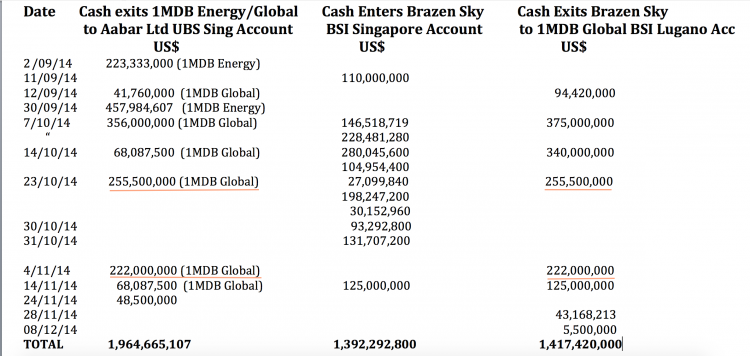

The figures from Chapter 2 item 8, make very interesting reading when compared to the bank transfer documents we publicised earlier in the week, which showed payments from 1MDB Energy and 1MDB Global to the Singapore UBS account of Aabar Limited during the relevant period in 2014.

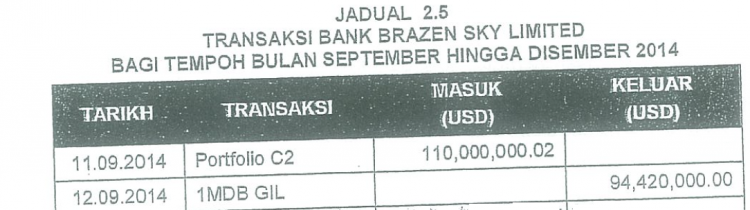

The AG shows the transfers allegedly made from the Cayman Island SPV to 1MDB’s Brazen Sky account at BSI Bank Singapore from Sept-December 2014. These were claimed by 1MDB to be ‘cash’ allegedly ‘redeemed’ from selling off the various portfolios that had been managed in the Caymans through Bridge Partners.

First look at the money that the Auditor General records as having arrived into Brazen Sky’s account (bearing in mind he complains he was not given any of the bank statements of the company to prove the origin of the cash):

“Difficulties in obtaining important documents such as the Brazen Sky bank statements and 1MDB GIL statements resulted in JAN not being able to verify the transfer of funds or payment of Aabar’s termination of option and interest payments” [AG Rpt 8.26.g]

Second, look at Sarawak Report’s table of money flows from 1MDB Energy and 1MDB Global into the UBS fake Aabar Limited account, published from bank transfer documents earlier this week.

Finally, combine the two tables to see how virtually identical over-all sums were sent to the fake Aabar by 1MDB Energy and later 1MDB Global to those which arrived back just a few days later in the Brazen Sky Singapore account – and were then forwarded straight on/back to 1MDB Global.

On two occasions the same multi-million sums left 1MDB Global to fake Aabar and then arrived back there (via Brazen Sky) on the very same day: US$255,500,000 on October 23rd and then US$222,222,000 on November 4th. Tony Pua would seem to have a point!

As Pua points out it was on November 4th, after the key figure of US$1.22 billion was flushed through Brazen Sky, that the auditors Deloittes finally agreed to sign off the belated accounts for that year on the basis that this money had been ‘redeemed’ from the Cayman Islands.

Except, the AG points out that instead of being repatriated to Malaysia to pay 1MDB’s pressing debts, as had been demanded again and again of management by the Board, this money was sent on to 1MDB Global’s BSI bank account in Lugano instead.

Or should we say it was SENT BACK to 1MDB Global’s BSI bank account in Lugano from where it had come in the first place?

The PetroSaudi black hole

In fact, all the evidence already forces the conclusion that there was never any money in the Caymans to be sent back in the first place, so this was nothing more than a desperate cover-up and an audit con-job that went to extraordinary lengths.

Indeed, once the money had been ‘redeemed’ to Lugano 1MDB management made sure to write it off straight away, claiming the money had been immediately spent on terminating options and paying off loans.

As everyone who has followed 1MDB knows, the original US$1.83 billion PetroSaudi investment (which was to go through no less than four different ‘investment strategies’ in as many years, to the Auditor General’s major disapproval) was actually stolen right from the start.

Jho Low’s Good Star Limited snaffled US$700 million on Day One, then a further US$330 million later in 2011. US$260 million was siphoned into the buy out of UBG in 2010 and the remainder went to PetroSaudi itself in return for its services in “acting as a front”. The formerly two-bit company bought itself a drill ship and purchased a lucrative drilling concession in Venezuela on the proceeds of its “joint venture”.

So, when 1MDB claimed in 2012 that it had ‘cashed in’ its share of the PetroSaudi venture for a fancy profit of US$2.3 billion they were defying the laws of mathematics and common sense. Who would have paid such money for an empty shell?

Hence began the series of twisted and turning shadowy tales about the supposed Special Purpose Vehicles, conveniently hidden in the Caymans with off-shore bank accounts, allegedly ‘investing’ in ‘portfolios’ that it was claimed could be translated back into solid cash.

No one believed Shahrol Halmi at the time and they will believe him even less now that they have seen how the money circulated round 1MDB in late 2014, with the help of the friendly off-shore fake Aabar and compliant Swiss bankers in Singapore.

The Auditor General was outrageously denied the full information he was owed to explain exactly what happened here, but what all the evidence suggests is that 1MDB started pumping money it had borrowed for its Energy and Global subsidiaries through the fake Aabar, so that it could then be sent on to Brazen Sky posing as cashed in profits from the separate Cayman Island portfolios.

No wonder that during this very November 2014 the management had started drafting resolutions to explain why 1MDB Global might need to pay money to Aabar – the remaining US$1.5 billion from their 2013 Tun Razak Exchange loan was about the only significant remaining ready cash available in the group. Hence the agreement to ‘extend the Aabar guarantee’ to this loan as well, in order to find an excuse to pay for the privilege. Aabar’s parent company IPIC have confirmed they knew nothing of the deal – the money went to the fake Aabar of course.

So, while the AG was not given the statements to prove this is what happened, his remarks could not have delivered a clearer official verdict of utter condemnation that nothing that was done was done correctly or honestly by 1MDB (see below). No wonder the Public Accounts Committee notified the police.

Remaining US$993 million

There was of course the alleged remainder of the SPV/Cayman money that the Board had called on 1MDB to return no less than 9 times for over a year:

The remaining money was US$993 and 1MDB had explained to the Board it would need to be used to pay off yet more options to the fake Aabar, for which purpose it was allegedly also paid to the Brazen Sky account.

Except, there turned out to be no money here either as the AG details in painful stages. First 1MDB had claimed they had sold the remaining SPV to fake Aabar again, because it was “as good as cash” although the market apparently was not keen on buying the SPV notes at that particular time.

Then the deal was reversed into an alleged cash sale, which turned out to be merely notes. The Auditor established that there was no cash in the BSI account, which was plainly why 1MDB had had to borrow real cash from Deutsche Bank to pay its mounting obligations, based on the supposed collateral which turned out to be notes not cash.

When the truth became known in April 2015, Deutsche Bank pulled its loan and 1MDB had to pull its favours with the corrupt Aabar officials, who dragged IPIC into a bail out. The Auditor provides a useful further insight into the terms of that secretive ‘Term Sheet’ with IPIC, which finally expired on June 30th with 1MDB having failed to fulfil its obligations to the Abu Dhabi fund, sparking legal action and a demand of US$6.5 billion, now facing the Malaysian taxpayer.

Many had asked what assets 1MDB had promised Aabar in return for its loan, as referred to in that binding term sheet. The answer, found the auditor, was that no one at 1MDB or Aabar actually seemed to know – even a year later. Because 1MDB had yet to demonstrate what were genuine assets and what were fake.

Read the Chapter 2 item 8 Translation

Chapter 2, Item 8 – Redeeming of investment portfolio from Segregated Portfolio Company (SPC)

8.1 The investment in the SPC was made through the Investment Management Agreement signed on Sept 12, 2012. Between the period of Sept 2012 and Sept 2013, the (initial) investment of RM6.8 billion (USD2.318 billion) saw a returns of RM662 million, which is dividends of RM445.93 million and capital distribution of RM216.07 million as stated in the financial statements for the year ending March 31, 2014.

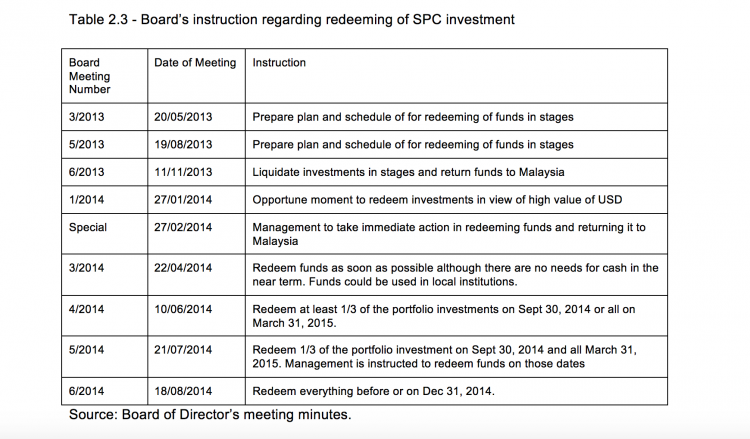

8.2 In response to criticisms that was raised in Parliament and through the media regarding the investment portfolio in the SPC which was managed by fund managers in the Cayman Islands, the Board had on May 20, 2013 agreed that the investment be redeemed in stages to improve public perception towards the credibility of 1MDB’s investments. In relation to this, the Board had issued 9 instructions between May 2013 and Aug 2014 to the Management to prepare a plan, schedule and (ultimately) redeem the SPC portfolio funds either in stages or as a whole, according to this schedule:

Table 2.3 – Board’s instruction regarding redeeming of SPC investment

| Board Meeting Number | Date of Meeting | Instruction |

| 3/2013 | 20/05/2013 | Prepare plan and schedule of for redeeming of funds in stages |

| 5/2013 | 19/08/2013 | Prepare plan and schedule of for redeeming of funds in stages |

| 6/2013 | 11/11/2013 | Liquidate investments in stages and return funds to Malaysia |

| 1/2014 | 27/01/2014 | Opportune moment to redeem investments in view of high value of USD |

| Special | 27/02/2014 | Management to take immediate action in redeeming funds and returning it to Malaysia |

| 3/2014 | 22/04/2014 | Redeem funds as soon as possible although there are no needs for cash in the near term. Funds could be used in local institutions. |

| 4/2014 | 10/06/2014 | Redeem at least 1/3 of the portfolio investments on Sept 30, 2014 or all on March 31, 2015. |

| 5/2014 | 21/07/2014 | Redeem 1/3 of the portfolio investment on Sept 30, 2014 and all March 31, 2015. Management is instructed to redeem funds on those dates |

| 6/2014 | 18/08/2014 | Redeem everything before or on Dec 31, 2014. |

Source: Board of Director’s meeting minutes.

8.3 However, no action was taken by the 1MDB management although there were specific clauses in the Subscription Agreement which allows the client to liquidate the funds at any time with a 30-day notice. The readiness of the management to liquidate the portfolio funds in a month was also confirmed by Hazem (then 1MDB CEO) during the Board Meeting on June 10, 2014.

8.4 Following repeated instructions from the Board, eventually, a portion of the SPC portfolio funds amounting to USD870 million were redeemed in mid-October 2014 while another USD300 million was redeemed a few days later. This was informed to the Board on Oct 20, 2014.

8.5 On Nov 4, 2014, Hazem informed the Board during a meeting that a total of USD1.2 billion from the SPC Portfolio Funds were redeemed. It was used to pay the interest on a loan and Aabar Investment PJS’s termination of option in order to secure 49% equity in Powertek Investment Holdings Sdn Bhd and 1MDB Energy (Langat) Sdn Bhd. During the same meeting, the chair of the Board had informed Messr Deloitte (who was present during the meeting) that the balance of the SPC portfolio investment would be redeemed before the end of November 2014 and gave a guarantee that he would oversee the redeeming of the funds.

8.6 During the meeting on Dec 20, 2014 Azmi (1MDB CFO) had informed the Board that the latest USD1.392 billion was redeemed from the SPC portfolio and the balance of USD939.87 million will be redeemed by the end of December 2014. The Board was also informed that the entire SPEC portfolio funds were used as collateral for the USD975 million loan from Deutsche Bank. The Board opined that it was unfair to use the entire SPC portfolio fund, valued at USD2.318 billion, as collateral when the loan from Deutsche Bank amounts to only USD975 million. Lodin (Board chair) raised the issue of 1MDB management not informing the Board regarding the collateral and that he and Ismee had given a guarantee to the BNM governor that money redeemed from the SPC portfolio investment would be brought back to Malaysia.

8.7 This information contradicts Arul Kanda’s statement to the PAC on Dec 1, 2015, in which he said that USD1.22 billion from the SPC portfolio funds were not used as collateral because it was already redeemed. Only the balance of USD1.11 billion from the SPC portfolio funds along with dividends of USD120 million were used as collateral with Deutsche Bank for the USD975 million loan. However, checks by JAN found that (Arul Kanda’s) statement was inaccurate because between Nov 14 and Nov 24, 2014, an additional USD173.5 million was redeemed, bringing the total amount redeemed from the SPC portfolio investment to USD1.392 million. All funds that were redeemed were transferred into the account of 1MDB GIL and only the balance of USD939.87 million which were not redeemed could be considered as collateral for the loan from Deutsche Bank.

8.8 Further checks by JAN on the Facility Agreement found that the conditions of the loan did not include clauses which support the statements of both Azmi (Dec 20, 2014) and Arul Kan (Dec 1, 2015). The conditions for the loan are as follows:

Table 2.4 – Condition for the USD975 million loan from Deutsche Bank AG, Singapore Regarding the SPC Portfolio Fund Collateral

| Clause | Condition |

| 20.2 (b) | Brazen Sky shall ensure that the Brazen Sky net worth will not at any time be less than USD1,500,000,000. |

| 22.2 (b) | With effect from the date which is six momths from the utilisation date, the borrower and Brazen Sky shall ensure that, at all times thereafter, the amount standing to the credit of Brazen Sky Account is at least equal to the Brazen Sky Required Balance.Note:Brazen Sky Account – Bank Account in Hong KongBrazen Sky Required Balance – a cash amount of USD600 mil up to a maximum of USD1,170 mil; USD500 mil plus aggregate of each Accordion Increase Amount x 1.2 [?] |

Source: Facility Agreement USD975 mil

8.9 The Board, during a meeting on Dec 20, 2014 was also informed that Deutsche Bank AG, Singapore had agreed to allow USD993, from the USD1.392 billion redeemed fromt he SPC funds, to be used for Aabar’s termination of option payments. The balance of USD399 million was used to pay the interest of the USD Note.

8.10 However, details of the USD993 million payment to Aabar for the termination of option and the payment of interest for the USD Note could not be verified by JAN. The board also sought details on the payment on Dec 20, 2014, but JAN’s checks showed that the matter not raised during the subsequent Board meeting. During the Feb 23, 2015 meeting, the Board had raised questions regarding the payment for Aabar’s termination of option which was only told to the Board after payment was made. This demonstrated that the payment for Aabar’s termination of option was made without the approval of the Board.

8.11 During a meeting between 1MDB and JAN on Sept 9, 2015, 1MDB had said that the physical payment to Aabar was made through the account of a 1MDB subsidiary – Brazen Sky Limited (Brazen Sky) through BSI Bank – on behalf of the terminating company because 1MDB did not own an account abroad. However, checks by JAN found that funds redeemed from the SPC portfolio amounting to USD1.392 billion which were transferred to Brazen Sky’s bank account between Sept 11 2014 to Nov 24 2014 were transferred to 1MDB Global INvestment Limited (1MDB GIL) between SEpt 12 2014 and Dec 8 2014 amounting to USD1.417 billion. An analysis on Brazen Sky’s transactions between Sept until December 2014 found that there were no payments for the purpose of the Aabar termination of option. Details of Brazen Sky’s transactions are as follows:

Chart 2.5 – Brazen Sky Limited Transactions for Period Between September and December 2014

| | Transactions | In (USD) | Out (USD) |

| 11/09/2014 | Portfolio C2 | 110,000,000.02 | |

| 12/09/2014 | 1MDB GIL | 94,420,000.00 | |

| 07/10/2014 | Portfolio C2 | 146,518,719.52 | |

| Portfolio C1 | 228,481,280.48 | ||

| 1MDB GIL | 375,000,000.00 | ||

| 14/10/2014 | Portfolio B2 | 280,045,600.00 | |

| Portfolio C1 | 104,954,400.00 | ||

| 1MDB GIL | 340,000,000.00 | ||

| 23/10/2014 | Portfolio A2 | 27,099,840.00 | |

| Portfolio B1 | 198,247,200.00 | ||

| Portfolio B2 | 30,152,960.00 | ||

| 1MDB GIL | 255,500,000.00 | ||

| 31/10/2014 | Portfolio A1 | 93,292,800.00 | |

| 31/10/2014 | Dividends | 131,707,200.00* | |

| 04/11/2014 | 1MDB GIL | 222,000,000.00 | |

| 14/11/2014 | Portfolio A2 | 125,000,000.00 | |

| 1MDB GIL | 125,000,000.00 | ||

| 24/11/2014 | Portfolio A2 | 48,500,000.00 | |

| 26/11/2014 | 1MDB | 43,168,213.17* | |

| 08/12/2014 | 1MDB GIL | 5,500,000.00 | |

| TOTAL | 1,392,292,800.02 | 1,417,420,000 | |

Source: Brazen Sky Limited Bank Statement, obtained from foreign authorities

Note (*): Not included in total amount

8.12 The transfer of funds redeemed from the SPC portfolio from Brazen Sky to 1MDB GIL was found to be in contravention of the instructions from the 1MDB Board, which has demanded that the funds be brought back to Malaysia. The Board’s approval was also not sought for this transaction. The reason for the transfer to 1MDB GIL by 1MDB’s management could not be ascertained because 1MDB GIL has its own investment assets with fund managers amounting to USD1.56 billion on March 31, 2014. 1MDB GIL had also obtained a USD Note loan amounting to USD3 billion. JAN was unable to verify 1MDB GIL’s subsequent payments or how the funds redeemed from the (SPC portfolio) funds were used because important documents such as bank statements and payment vouchers were not handed by 1MDB for JAN’s verification despite five requests being made between May and October 2015. Documents such as bank statements should be readily available to bank clients.

8.13 After redeeming USD1.392 billion from the SPC portfolio, the Board on Nov 13, 2014 urged (the management to) redeem the balance of USD939.87 million before the end of November 2014. The same instruction was given again on Nov 25, 2014.

8.14 On Jan 12, 2015, the Board voiced their disappointment with the 1MDB management who had previously given the impression that the SPC funds would be brought back (to Malaysia) but as of that day, it had not happened. The situation then became more complicated because 1MDB was facing serious cash-flow problems in its attempt to repay a RM2 billion Maybank loan and payment obligations for equity in the 3B Project [Note: Jimah power plant] at the time.

8.15 During the same meeting, Arul Kanda had informed the Board that the balance of the SPC portfolio funds amounting to USD939.87 million was redeemed and held in the form of cash since Dec 31, 2014. This was in line with what Azmi told the Board on Dec 20, 2014 – that the balance would be redeemed by end-2014.

8.16 However, checks by JAN found several statements which raises doubts on whether the balance of the SPC funds amounting to USD939.87 was in the form of cash or units. An analysis on the statements made between Jan 12, 2015 until Mar 3, 2015 showed that the redeeming of SPC funds in the cash amounting to USD939.87 had taken place. However, checks by JAN found that the sum of USD939.67 did not exist in Brazen Sky’s bank account during the period. The chronology of statements regarding the redeeming of SPC portfolio investment is as follows:

Table 2.6 – Chronology of statements regarding redeeming of the balance of SPC portfolio investment funds amounting to USD939.87 million

| Statement | Source | |

| 12/01/2015 | Mr Arul updated the Board that the balance of USD939,874,085 had been redeemed and had been held as cash since Dec 31, 2014. | Special Board Meeting |

| 07/02/2015 | Mr Arul: “The cash is in our accounts and in US dollars. I can assure you (about that) … I have seen the statements”. | The Business Times, Singapore, Feb 7, 2015. |

| 23/02/2015 | Mr Arul informed the Board that, per the terms of the Deutsche Bank loan taken out in Sept 2014, there is a need for the USD975 million loan to be cash-collateralised at USD1.20 for every USD1.00 of the loan, by March 2, 2015. He therefore recommended, and that Board agreed, that the loan be repaid from the remaining USD939 million cash proceeds from the redemption of the investment portfolios held by Brazen Sky Limited, and the balance from the proposed Government of Malaysia loan. | Board meeting No 1/2015 |

| 03/03/2015 | Mr Arul updated the Board that further to the Board decision on Feb 23, 2015 he had instructed the CFO to utilise the proceeds of Brazen Sky Limited redemption to repay in full the USD975 million Deutsche Bank loan on March 2, 2015. However, the CFO informed him today that BSI apparently declined to apply the proceeds in that manner until they received a suitably worded indemnity from Deutsche Bank to release BSI from any liability in relation to application of the funds in that manner. | Special Board meeting |

Source: 1MDB board minutes and news articles

8.17 Arul Kanda’s statement to the Board on March 3, 2015 raises the question of why BSI had previously shown no objection towards the transfer of the monies from the SPC portfolio investment amounting to USD1.417 billion between Sept 12, 2014 until Dec 8, 2014. This appears to show that 1MDB’s management did not provide the correct or complete information regarding the SPC investment (money) to Arul Kanda. Arul Kanda had frequently attributed the information he was presenting during Board meetings to Azmi (CFO) and Terence (Executive Director, Finance). During PAC’s meeting on Dec 1, 2015, Arul Kanda also acknowledge that his understanding of the redeeming of SPC funds was learned in stages. Azmi and Terence, as the directors of Brazen Sky, should have provide details about the SPC portfolio investment to Arul Kanda.

8.18 During the Board meeting on March 24, 2015, Arul Kanda explained, based on information supplied by Azmi, that Aabar agreed to purchase the balance of the SPC portfolio investment fund amounting to USD939.87 million from Brazen Sky at the same value. Checks by JAN found that the agreement that was referred to was the Asset Sale Agreement signed on Jan 1, 2015 between Brazen Sky and Aabar Investments PJS Limited (Aabar Ltd). The agreement was made by 1MDB management to ensure that the receipt of funds redeemed from the balance of the SPC portfolio can done before March 31, 2015 in accordance to the wishes of the Board. The redeeming of the funds was done through an agreement because Brazen Sky was of the opinion that the SPC fund managers were unable to redeem the SPC funds through normal redeeming processes because of weak market sentiments at the time. However, it was found that the agreement was signed without prior knowledge of the Board and shareholders.

8.19 Checks by JAN also found that the sale of the balance of SPC portfolio investment to Aabar Ltd contradicts Clause 21.4 (a) in the USD975 million Facility Agreement by Deutsche Bank – “No obligor shall enter into a single transaction or a series of transactions to sell, lease, transfer or otherwise dispose of any asset.” This showed that the management had acted against the instructions of the Board which required the redeeming of SPC portfolio investment before the end of Dec 2014 and that the proceeds be brought back to Malaysia. The management’s justification for not carrying out the instruction in January 2014 can be disputed because the value of the USD at the time was high. 1MDB’s management should rightfully not be concerned about losses during the redeeming process because the value of the SPC portfolio investment was guaranteed by Aabar Investment PJS on the principle value.

8.20 Arul Kanda also told the Board on March 24, 2015 that Azmi had explained that the redeeming of the entire SPC portfolio investment had happened in early January 2015. However, a sum of USD939.87 which should be received from Aabar was still in the SPC portfolio fund structure. Since 1MDB’s management took into consideration of Aabar’s credit position and the good relations between the two companies, the agreement in which Aabar takes over the SPC portfolio investment was considered to be “as good as cash”. However, without the cash payment, 1MDB was unable to repay its debt of USD975 million to Deutsche Bank or prepare a cash collateral of USD1.17 billion for the loan.

8.21 Following this, the Board through a resolution dated March 25, 2014 agreed with a proposal by Azmi and Terence for Brazen Sky to terminate the Asset Sale Agreement, dated Jan 2, 2015, with Aabar Ltd and replace it with a Share Sale Agreement. According to the proposal, all equity in Brazen Sky is to be sold to Aabar Ltd at a consideration value of USD1.20 billion and the first payment of USD300 million must be made before April 30, 2015. The purpose of selling Brazen Sky was to fulfill the condition set by Deutsche Bank regarding the cash collateral of USD1.17 billion which must be prepared by Brazen Sky on behalf of the lender – 1MDB Energy Holdings Ltd. The shareholders agreed with the proposal via a resolution on March 25, 2015. However, this document was not presented to JAN because 1MDB’s management said that the deal was not yet finalised. All statements to the board on March 24, 2015 – beginning with the Asset Sale Agreement and proposed Share Sale Agreement – give the impression that information is being changed according to the situation, in which the balance of the SPC portfolio investment which was initially said to have been redeemed in cash, but is now reported to be in the form of units.

8.22 Thus, Aabar Ltd’s commitment to uphold their end can be questioned because Azmi had told the Board on April 23, 2015 that the balance of USD939.87 which should have been received by Aabar Ltd was still in the structure of the SPC portfolio investment because Aabar Ltd had yet to confirm when the payment should be made. Meanwhile, Arul Kanda told the Board on May 11, 2015 that the takeover of Brazen Sky by Aabar Ltd had yet to take place.

8.23 However, on May 25, 2015 the Board was informed that negotiations with Aabar were taking place, in which IPIC/Aabar were to takeover a portion of 1MDB Group’s assets alongside obligations for two USD Notes amounting to USD3.5 billion. The Board was also informed that the agreement and advance payment of USD1 billion will be finalised by the end of May 2015. This is the third time the redeeming of the balance of the SPC portfolio investment and negotiations with Aabar/Aabar Ltd was changing in shape.

8.24 On May 28, 2015 the Board approved through a resolution to have a Term Sheet for Settlement Arrangements (Binding Term Sheet) between 1MDB Group, Ministry of Finance Inc (MKD), International Petroleum Investment Company (IPIC) and Aabar Investments PJS Groups (Aabar). The Binding Term Sheet was signed by all four parties on May 28, 2015. Among the important terms in the Binding Term Sheet was that IPIC will pay 1MDB USD1 billion before or on June 4 2015 and takeover the obligation to pay interest and principle for the two USD Note – each amounting to USD1.75 billion. According to Arul Kanda’s explanation to the Board on June 14, 2015, the Binding Term Sheet did not state in detail which assets would be transferred to IPIC/Aabar because it is still under negotiation. Among the assets which have been identified amounts to USD4.892 billion, consisting of a deposit amounting to USD1.4 billion for the IPIC guarantee on the USD Note, 1MDB GIL investment fund amounting to USD1.56 billion, the SPC portfolio investment amounting to USD939.87 million and payment for the Aabar termination of option amounting to USD993 million. Three important issues have been set for the following dates:

- A definitive agreement must be implemented by July 31, 2015

- Transfer of assets at the minimum value of USD1 billion to IPIC/Aabar by Dec 31, 2015

- Transfer of the balance of asset that have been identified by June 30, 2016

8.25 On June 5, 2015, 1MDB had received the advance of USD1 billion from IPIC under the Binding Term Sheet through its subsidiary Brazen Sky. Based on the shareholders resolution on May 28, 2015 and resolution by the Board dated June 2, 2015, the sum was to be used for the payment of USD50 million in fees to Yurus Private Equity I and the balance was for the Deutsche Bank loan amounting to USD975 million.

8.26 Issues regarding the redeeming of SPC Portfolio INvestment for the period between 2013 and 2015 are as follows:

- Payments for the Aabar termination of option were not put before the Board for prior approval

- Proceeds of funds redeemed from the SPC portfolio amounting to USD1.392 billion was not brought back to Malaysia as instructed by the 1MDB Board

- Proceeds redeemed from SPC portfolio amounting to USD1.417 billion were shifted to 1MDB GIL but the Board was told that it was used for the Aabar termination of option payment amounting to USD993 million

- Difficulties in obtaining important documents such as the Brazen Sky bank statements and 1MDB GIL resulted in JAN not being able to verify the transfer of funds, payment of Aabar’s termination of option and interest payments

- The Asset Sale Agreement signed on Jan 2, 2015 between Brazen Sky and Aabar Ltd for the sale of the balance of SPC portfolio investment amounting to USD939.87 milllion to Aabar Ltd was signed without the knowledge of the Board or shareholders.

- The value of the first redeeming process (USD1.392 billion) and the balance which will be taken over (USD939.87 million) amounts to USD2.33 billion, which is almost the same as the initial investment amount of USD2.318 billion on Sept 12, 2012. This shows that the SPC portfolio investment did not make significant gains.

- The change in statements on the balance of the SPC portfolio investment – first it was said that it was redeemed and kept in cash on Dec 31, 2014, subsequently it was stated that it was taken over by Aabar Ltd on Jan 2, 2015, but still regarded as “good as cash” although no money was received.

8.27 In summary, 1MDB’s initial investment through PetroSaudi in 2009 which involved a large sum did not bring foreign investment into Malaysia, which was not in line with the objective of establishing the company. […] 1MDB’s early investments through funds from the issuance of IMTN bonds amounting to RM5 billion saw a change in investment instruments four times. Beginning with the USD1 billion equity investment in 2009 through the JV with a subsidiary of PetroSaudi International Limited, followed by the investment in Murabahah Note (USD830 million/RM2.59 billion) in 2011 and 2012, until it was changed to into the SPC portfolio investment amounting to USD2.318 billion in Cayman Islands on Sept 2012. A portion of the SPC portfolio investments was redeemed in 2014 and used to finance various commitments and its investments. This investment resulted in a balance of USD939.87 million in the form of SPC portfolio investment units on March 31, 2015.

8.28 The decision to switch from one investment instrument to another within a short period of time while involving large sums showed that the investment decisions were not made in accordance with a proper management structure and does not appear to have a long term strategic investment plan.

8.29 Issues that were uncovered depicts a company which had made unwise business decisions, took high risks and was not in line with 1MDB’s status as a Government-owned strategic development company to help develop the country. It should be managed in accordance to best practices in order to safeguard the company and Government’s interest.