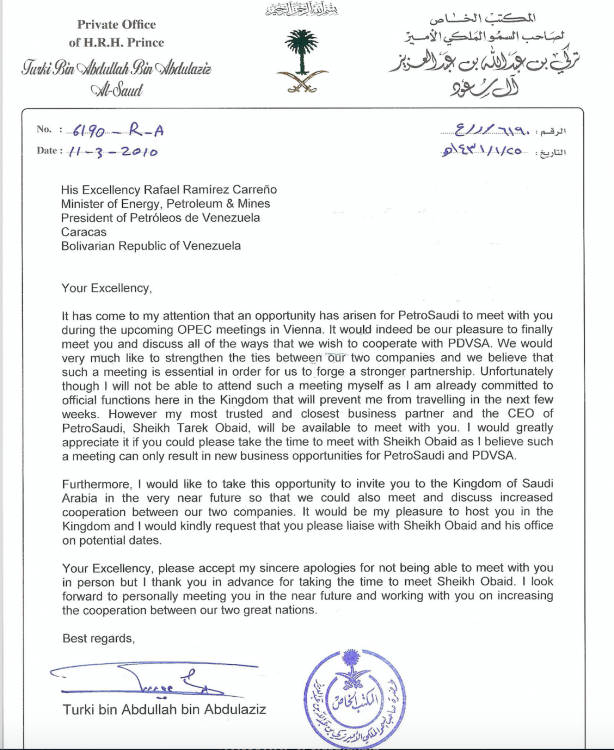

Early March 2010 a lordly letter was delivered to the all powerful President of Venezuela’s state petroleum company PDVSA, who was also Minister of Energy, Rafael Ramirez. It was from one Prince Turki bin Abdullah, who numbered among the then King of Saudi Arabia’s many sons.

The tone was grandiloquent, but there was an amateurish feel to this official communication and the content had little to do with diplomacy:

“It would indeed be a pleasure to finally meet you and discuss all of the ways that we wish to cooperate with PDVSA… Unfortunately though I will not be able to attend such a meeting myself as I am already committed to official functions here in the Kingdom that will prevent me travelling in the next few weeks. However my most trusted and closest business partner Sheikh Tarek Obaid, will be available to meet with you..”

“It has come to my attention that an opportunity has arisen for PetroSaudi to meet with you during the upcoming OPEC meetings in Vienna. It would indeed be our pleasure to finally meet you and discuss all of the ways that we wish to cooperate with PDVSA.

We would very much like to strengthen the ties between our two companies and we believe that such a meeting is essential in order for us to forge a stronger partnership. Unfortunately though I will not be able to attend such a meeting myself as I am already committed to official functions here in the Kingdom that will prevent me from travelling in the next few weeks. However my most trusted and closest business partner and the CEO of PetroSaudi, Sheikh Tarek Obaid, will be available to meet with you. I would greatly appreciate it if you could please take the time to meet with Sheikh Obaid as I believe such a meeting can only result in new business opportunities for PetroSaudi and PDVSA.

Furthermore, I would like to take this opportunity to invite you to the Kingdom of Saudi Arabia in the very near future so that we could also meet and discuss increased cooperation between our two companies. It would be my pleasure to host you in the Kingdom and I would kindly request that you please liaise with Sheikh Obaid and his office on potential dates.

Your Excellency, please accept my sincere apologies for not being able to meet with you in person but I thank you in advance for taking the time to meet Sheikh Obaid. I look forward to personally meeting you in the near future and working with you on increasing the cooperation between our two great nations.”

The text for this missive had in fact been sent hastily the day before in an email from Tarek to Turki entitled “PDVSA Letter Urgent”.

It illustrates how PetroSaudi presented itself in Venezuela, which was just the same way as it had in Malaysia and in the various other parts of the world, where the young playboy Tarek Obaid was trying to peddle his access to the Saudi royal family and supposed diplomatic influence, in order to make a fast buck.

Prince Turki has since severed his ties with Obaid’s businesses, but at the time the former airforce pilot was a 50% shareholder and proved very willing to sponsor his young pal’s efforts to try and make money out of his royal connection. To begin with, say insiders, it helped open the door to what the colleagues hoped would be a major money making opportunity in a country where few others dared to trade.

Tarek, who had limited means of his own, meanwhile inflated the reality of his own position in Saudi Arabia as much as possible.

“I understood he was the Prince’s nephew” one business contact told Sarawak Report. To which another, who knows better, says not true: “he is nobody in Saudi Arabia, he has no royal blood, he was the son of a once wealthy businessman who lost all his money”.

Argentina debacle

The first serious investment into PetroSaudi, which was only incorporated in 2005, came from an emerging market fund run by the private equity group Ashmore. It involved the purchase of a supposed oil asset in Argentina in 2008, which Tarek apparently had no intention of developing (PetroSaudi had no capacity), but seemed to think that he could flip on to the Chinese for a big profit.

“It was super, mega-early stage” an insider has told Sarawak Report, “the only people who would seriously invest in an opportunity like this would be some huge outfit like Exxon and they would pay nothing for it, because only they would know what to do”.

But, friends of Tarek had suggested otherwise and his old schoolfriend Patrick Mahony, who then worked for Ashmore, pursuaded the group to take up the investment and sink some $50 million into the project. An insider explained why they made that decision. “The only reason Ashmore invested was because the deal with PSI [PetroSaudi International] was that Tarek or ‘The Kingdom’ would guarantee a 35% return, whether or not it failed”.

However, when the project did predictably pan, Tarek did not pay and nor did his royal partner get Saudi Arabia to pay either. “Ashmore were incensed” our contact told us.

However, Tarek reckoned he knew exactly how to play that situation. He warned Ashmore that if they made trouble for him he would ensure the company’s valuable Saudi investors pulled out of the fund. Ashmore walked away.

Again, people who know him better confirm that Tarek has no such influence in the Kingdom. However, it is a trick that Obaid has played more than once, according to various sources: persuading anxious outsiders that he can destroy their connections in the secretive kingdom if they cross his wishes or do business with people he doesn’t like.

It was this worthless “asset” in Argentina that PetroSaudi was to later inject as part of its contribution to the 1MDB PetroSaudi Joint Venture, having had it valued by their own hired valuer, Ed Morse, as being worth up to $200 million dollars.

Key partner from the start – Patrick Mahony

This was not the only project at Ashmore involving Patrick Mahony which involved big risks that lost big money. Mahony had joined Ashmore from Blackstone in 2006 and was also the portfolio manager behind an investment of some $200 million in a Turkish port project with partners, whom some warned had a dubious business history.

“There was a sort of hubris about knowing how to do business with emerging markets – how to work with people who were dodgy. But, if you deal with scorpions you should know what to expect” reflects one former associate. The partner stole Ashmore’s share of the venture and then refused to pay up on a court judgement.

Nevertheless, Tarek and Patrick clearly continued to work together, taking the same risky approach.

They had been in class together at the same Geneva private school and they shared a taste for the same kind of socialising, which generally involved louche gatherings at the most expensive locations, in the company of rich movers and shakers and lots of hired Russian models, say various associates whom Sarawak Report has questioned.

Tarek would cadge the money to pose as a playboy, but it was all acting and both men sought real wealth.

By 2009 the pair were seriously pushing the PetroSaudi business model as their opportunity to maximise their supposed ‘royal access’ in the oil kingdom: “Tarek’s business model was not to invest, it was signing up to play the Saudi business card. He would put zero money in, but expect to get a stake. But, it was never really clear how close he really was to the KSA”, explains a finance industry observer.

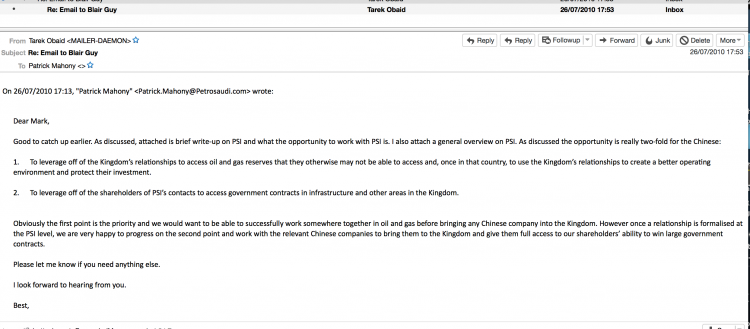

It was Patrick Mahony who drew up the template that Obaid started to use as he hunted for willing investors, particularly from China. The document was called “Basic Story On PetroSaudi” and it purported to explain what it was that teaming up with the microscopic little company had to offer huge outfits like Sinochem, which for a while showed interest.

It was all based on PSI’s purported ability to wield Saudi diplomatic influence and backing for the company’s global business interests. PSI was even acting as a proxy for Aramco in acquiring interests in foreign oil wells, which the state company is barred from doing, the document claims. As such it was really a front for the Saudi Royal Family and the King himself the narrative implied:

Basic story on PetroSaudi (PSI):

PSI was founded by HRH Prince Turki bin Abdullah bin Abdulaziz al Saud (the son of King Abdullah, the current King of Saudi Arabia) and Tarek Essam Obaid (from a prominent business family in KSA). PSI was set up to take advantage of the desire of many countries with oil and gas reserves not to hand over their resources over to the big multinationals (Shell, BP, Exxon etc) and to work with governments or companies that they believe are more like-minded and not just trying to make massive profits off of hydrocarbons they feel belong to them. Many of these countries do not have the money or technology to exploit their resources so they do need to work with partners. Saudi Arabia is an obvious choice of as it has both the capital and the significant expertise through its national oil company, Aramco (the largest oil company in the world). Unfortunately though, Aramco’s mandate does not allow it to own upstream assets outside of KSA. It can own downstream assets (though it is currently divesting these, for example the refinery in the Philippines that Ashmore recently purchased from them) but not upstream. As such, Prince Turki and Tarek saw an opportunity to bring Saudi capital and technology to nations that needed it to develop their hydrocarbon industry through a private vehicle, PetroSaudi.

PSI’s aim is to approach nations with strong ties to Saudi Arabia and use the friendly relationship with these governments to give it access to upstream oil and gas assets. Governments have been very welcoming to PSI because they feel they are working with a quasi-sovereign entity (given that it is a vehicle of the Saudi Royal Family) and one that understands them. So PSI has had privileged access to many hydrocarbon regions in the world (the Caspian, Africa, Latin America) and is currently acquiring assets in these regions. Unfortunately though the scale that PSI is reaching is rapidly becoming a bit big for it and the resources required are very large so PSI needs a partner that has a) the appetite for the oil and b) the capital, technical and human resources to help it progress and develop all of the assets it is accessing. Of course PSI has been approached by all of the majors, the Chinese etc but, like the governments it is working with, PSI wants to work with a like-minded partner and one that understands the sensitivities around how PSI is leveraging off of the Kingdom’s relationships to gain access to these hydrocarbons. It is very important that any partner understands KSA well and also appreciates the reasons why PSI is allowed to operate in a given country.

This is a pretty unique opportunity for an oil and gas company or an investor to partner with a vehicle that will grant it unrivalled access to many hydrocarbon regions of the world and can also protect any investment they make in these regions. This last point is important because as you can see with Shell in Nigeria, BP in Russia, many countries will get a company in but then bully it around once it is there and has sunk many dollars in the ground. This will not happen with PSI because these nations do not want to get on the wrong side of the Saudi Royal Family (you have to remember that Saudi matters hugely in the oil world and there is a lot of Saudi aid to these countries, some are fellow Muslim nations etc.). The first point is important too because many of these countries cannot even access some countries that PSI is already operating in. Furthermore PSI has full support from the Kingdom’s diplomatic corps when entering and operating in these countries.

Obaid used the same document to net in Tony Blair as a very highly paid consultant to PetroSaudi in 2010.

In an email he further told Blair’s office that whilst the first step was for investors to put money in projects that would gain Saudi diplomatic support in places where that could be crucial, the second advantage would be preferential treatment and opportunities to get contracts in Saudi Arabia itself:

“We are very happy to work with the relevant Chinese companies to bring them to the Kingdom and give them full access to our shareholders’ ability to win large government contracts” Tarek told Blair’s people:

Needless to say, it was all bluff, aided by the opaqueness of Saudi Arabia to foreigners and the widespread perception of its royal family as being all-powerful and untouchable…. and possibly corrupt.

1MDB

By 2009 Tarek’s blatant pitch had attracted the attention of 1MDB advisor Jho Low, who had been seeking just such a vehicle to assist his “Big Boss” Najib’s purpose of siphoning money out of the fund.

Jho Low recognised PetroSaudi for what it was, a bogus front company, which acted big and flashed a great figurehead in return for a pay-off.

The royal facade certainly went down well with Malaysian PM Najib and wife Rosmah, who were delighted if they could give the impression of a big shot Saudi investment as they took the money out of 1MDB.

Turki hired a yacht for a week and pretended he owned it, causing Rosmah to boast to all her friends about her rich connection. Suitably impressed by Jho’s catch, the Malaysians were willing to let the Saudis take 30% of the enormous first billion ‘investment’ by their fund and the rest was siphoned by the PM’s own proxy, Jho Low.

Which is why by the time PetroSaudi engaged in their next venture in Venezuela they also had what that country was looking for as well, which was up-front cash.

Venezuela

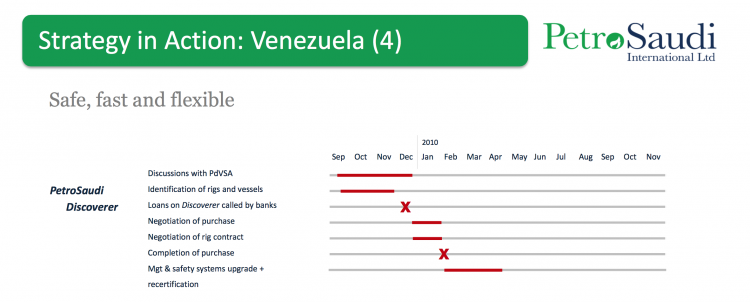

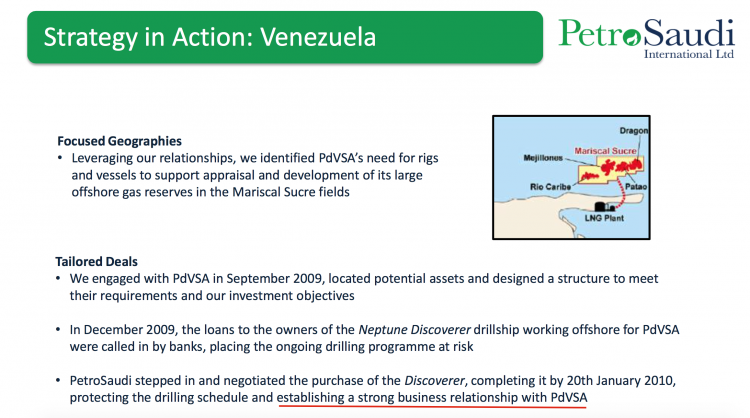

The fact that PetroSaudi had started negotiating with Venezuela’s state oil company PDVSA within days of beginning the 1MDB joint venture deal owed again to Patrick Mahony.

Mahony was still working for Ashmore, although he was now also a PetroSaudi director, and he believed he had spotted an opportunity through Ashmore’s own portfolio to make big returns on the money due to flow into the ‘1MDB Joint Venture’. He was also doing Ashmore a big favour.

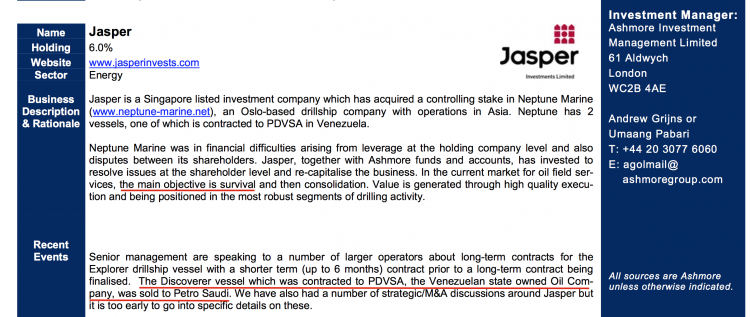

Ashmore had put money into a floundering investment that was in deep trouble in Venezuela, based on an elderly drill ship later to be re-named Neptune Discoverer. The project, then called Jasper, was one of the Ashmore’s top ten emerging market investments and the company’s stock exchange reports spelt out the problems:

Mahony reckoned he could relieve his soon to be former employers of a cut-price drill ship and, according to associates, thought he would be able to make money from it where others could not in cash-strapped Venezuela:

“Discoverer was under contract with PDVSA, but as with most suppliers to PDVSA (then and now) they had trouble collecting from PDVSA. I think Patrick and pals thought they had a ‘fixer’ in Venezuela that was close to the Chavez government and thought they could facilitate ‘timely’ payments from PDVSA”

was how one fellow fund manager put it.

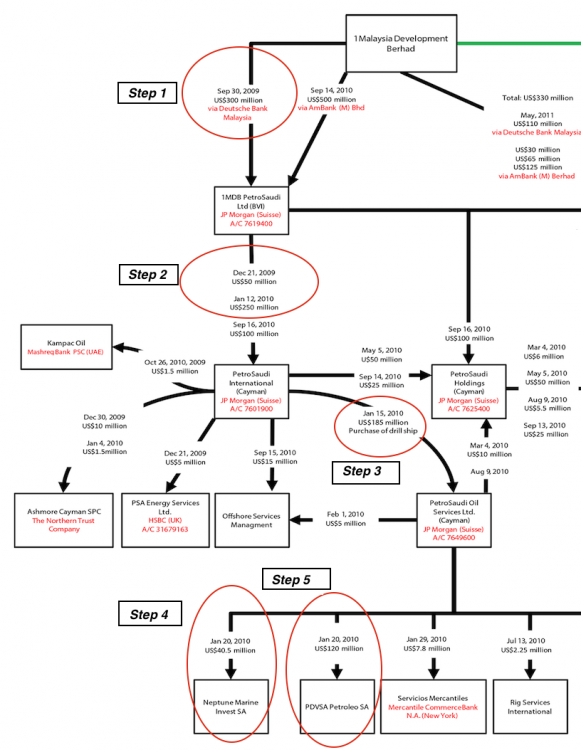

By January 2010 all the $300 million which had been sent by 1MDB into the joint signatory/ joint venture account of 1MDB PetroSaudi Limited had been signed over to PetroSaudi’s Venezuela project.

PetroSaudi had informed 1MDB officials that they were paying $250 million for their drill ship, but in fact they only put down $40 million on the elderly barge and another $120 million was paid in cash to structure a joint venture deal with PDVSA.

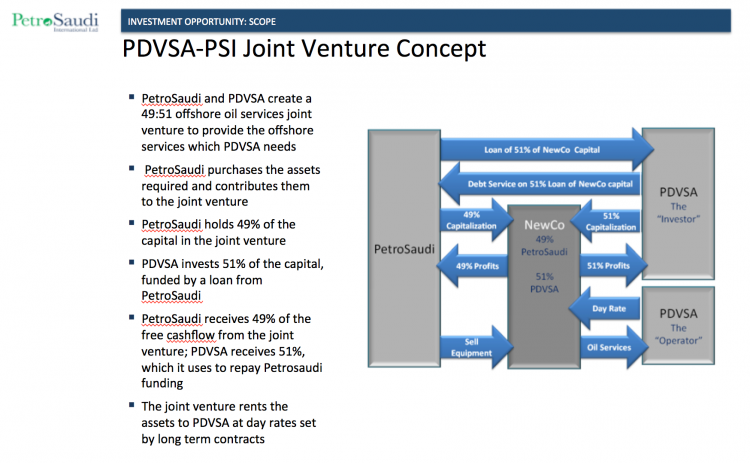

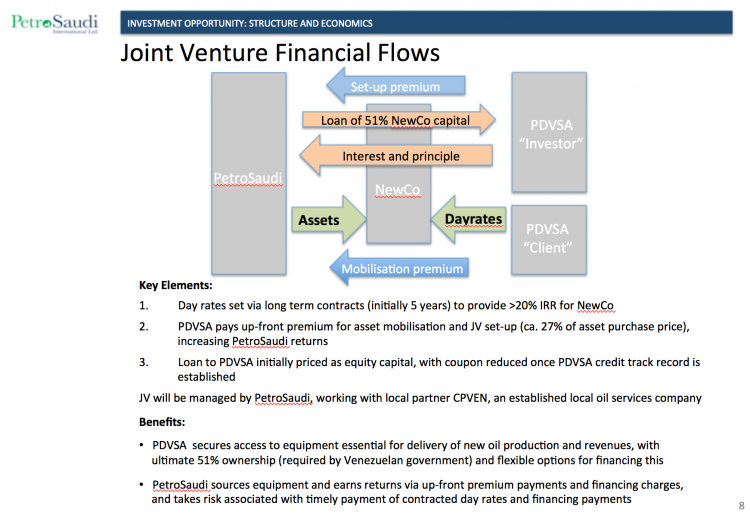

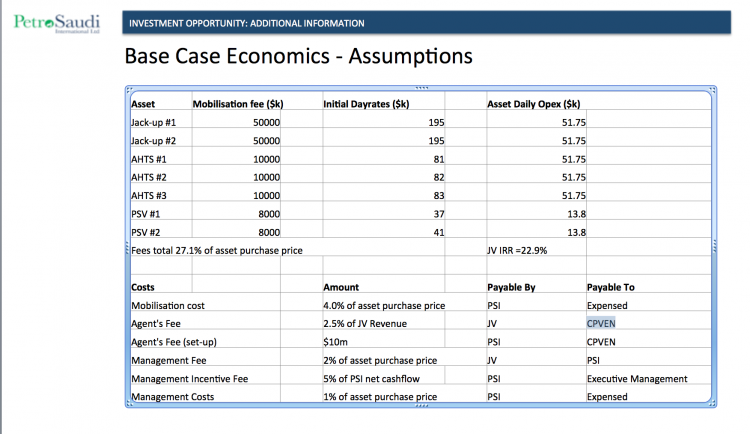

PetroSaudi’s presentation documents designed to attract further investors explained how the company reckoned it could structure a lucrative deal by providing PDVSA this money and equipment up-front – although the exact uses planned for that $120 million cash injection remained vague:

In its literature PetroSaudi boasted it had succeeded in extracting hugely advantageous terms with a five year fixed contract for its drill ship Neptune Discoverer (it was 7 years for Saturn) with a daily fee that would guarantee a 30% annual return on the initial investment; a sky high rate of interest on the loan – over 20% – and a ‘mobilisation fee’ up-front, which itself amounted to nearly a third of the company’s inital outlay on the asset:

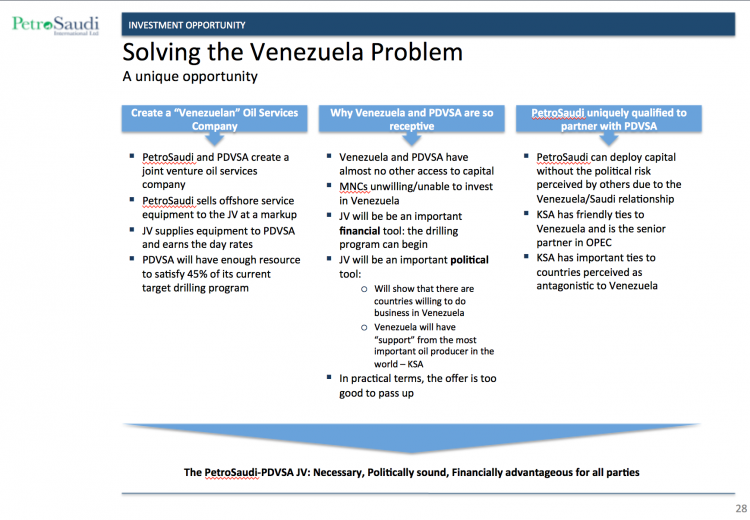

PetroSaudi’s self-promotion as an arm of the Saudi state and royal family seems to have played a significant part in pushing through these excellent terms. Correspondence shows that the company was presenting the deal as an opening round in what could be serious Saudi investment in the country’s collapsing oil infrastructure.

But that whole facade was soon to fall apart and by 2011 the clapped out Discoverer had to be de-commissioned – according to one expert observer who spoke to Sarawak Report:

“In March 2011 the workers demanded the evacuation of this barge, now called Petro Saudi Discoverer, due to the deplorable conditions of the equipment. They demanded that Jose Luis Parada, head of PDVSA Services, detain the operations and evacuated the 103 workers in the barge. The barge, they said, lacked the international certification from the American Bureau of Shipping”.

However, there was another reason Mahony and Obaid believed they could sustain their contract and get Venezuela to honour its payments, which was because of their unique inside contacts.

They had used those contacts to help lock PDVSA into a Letter of Credit arrangement linked to the deployment of the second ship Saturn, meaning a bank had agreed to pay the contract, whether or not Venezuelan officials came back later to quibble over those extortionate terms.

Taking advice from their favourite top London law firm White & Case, PetroSaudi battled with their Venezuelan negotiators to insist that the Letter of Credit for $130 million was issued under UK jurisdiction and not Venezuelan, which was required of all such contracts under Venezuelan law. This was to prevent the payment being frustrated by local protective measures.

However, the Venezuelans said this procedure was not acceptable under their own laws and emails show that negotiations were tense with Mahony’s local ‘fixers’ placed under pressure. At last, the day before the contract was due to be signed, the fixer told Mahony that he could get the deal through, but they must only allow the finished form of the contract to be seen by one top official and two named juniors and it must not be sent to anyone else. These people would handle the situation.

That top official was Jose Luis Parada, who was later arrested and jailed on grand corruption charges, before managing to escape to Canada after reportedly paying a $30 million bribe.

Parada’s boss, the Minister cum PDVSA President Rafael Ramirez (who met with Tarek Obaid) is also no longer in his job. His friend Hugo Chavez appointed him to a diplomatic post to give him immunity after an enquiry by the country’s National Assembly accused him of misappropriating $11 billion during his 10 years in the job.

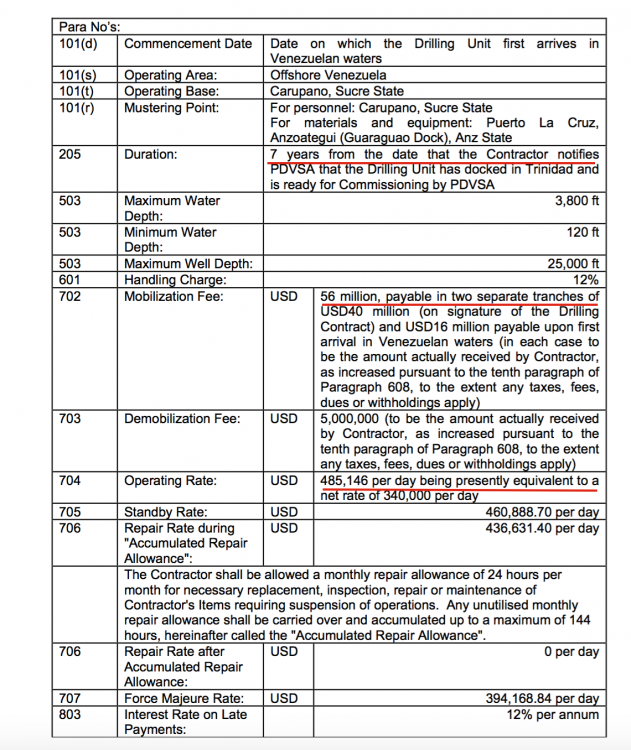

That Saturn contract allowed for a staggering $485,000 fee payable per day on a fixed contract for seven years – at least double the market rate. When the PDVSA negotiators attempted to put in further break clauses on the contract PetroSaudi aggressively refused, saying the drill ship’s daily fee must be guaranteed. It was this demand that the intermediaries also requested be only sent to the three men in the Ministry.

Patrick’s ‘Special Fixers’

Venezuelan oil analysts have told Sarawak Report that they were immediately suspicious of the arrival of PetroSaudi, whom they immediately identified as a non-professional bunch of speculators rather than a genuine oil company.

“When I looked Petro Saudi up I found it to be a company created in 2005 without oil operational experience, along the lines of a financial speculator, managed by a gentleman called Tarek Obaid, who seemed to be an international playboy, more involved with Formula One activities than with the oil business.

I also found out that the other barge offered to PDVSA, the 34 year old Neptune Discoverer, had been bought from Jaspers Investments for a price of some $120-150 million, $50 million below book value. Their performance has been dismal. It took two years for the Discoverer to drill the first well, while in Trinidad a similar well could be completed in 30-45 days.”

comments one senior veteran of the industry and well-known critic of PDVSA, Gustavo Coronel.

A well known scandal in Venezuela at that time was the sinking of another below standard drill ship called Aban Pearl in early 2010. Coronel discovered that this Indian barge had a contract paying it $700,000 per day to drill wells, although the owners had agreed to only recieve $300,000 of that.

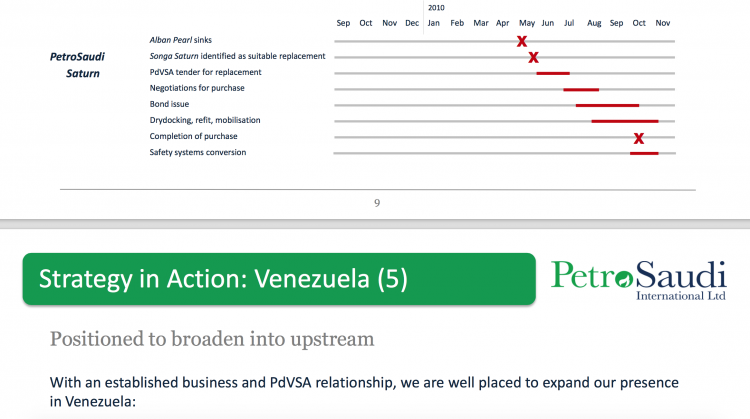

For years he and other Venezuelan observers have suspected a similarly inflated contract for Discoverer and for PetroSaudi’s second ship Saturn, which Patrick Mahony negotiated quick as a flash to replace the Aban Pearl straight after it sank. Saturn cost $250 million and Mahony leveraged the payment after he extracted another $500 million from 1MDB in September 2010 (this time in the guise of a Murabah loan agreement, of which $260 million went straight to Jho Low’s UBG buy out).

Sarawak Report has obtained copies of the hidden contracts from the PetroSaudi data in our possession, which confirms the extortionate terms PetroSaudi extracted from PDVSA. For the Saturn contract PetroSaudi negotiated a daily ‘Operating Rate’ payment of $485,146 (worth over $1.2 billion over the seven year duration of the contract) merely for PDVSA to operate its drill facility (which in the case of Discoverer only drilled one well).

“It is more than double the going rate” one industry insider has confirmed to Sarawak Report. On top of that there was a vastly inflated ‘Mobilisation Fee’ of $56 million, which ought have been no more than $15 million, according to Coronel, himself a former geologist. Added were hefty accomodation fees for the army of workers, to whom PetroSaudi sub-contracted all the actual work – and finally, of course, the enormous interest rates charged on the original loan to the ‘Joint Venture’.

With returns like these on two second-hand drill barges and a solid 7 year contract for Saturn there would even appear to have been a theoretical possibility that PetroSaudi could after all have paid back 1MDB’s original $1.83 billion loan over the given period along with some profit.

However, Venezuela was in corruption-induced economic free-fall and the ships were third rate vessels that failed to perform, so could it have been any surprise to the Directors of PetroSaudi when it turned out to be hard to extract the promised payments after all?

The reason why this small circle of apparently very corrupt officials had agreed to push through such a disadvantageous deal for their country is certainly open to speculation – as is what exactly happened to that $120 million of 1MDB’s money that had been injected into the deal up front.

Who were Mahony’s “Special Fixers”?

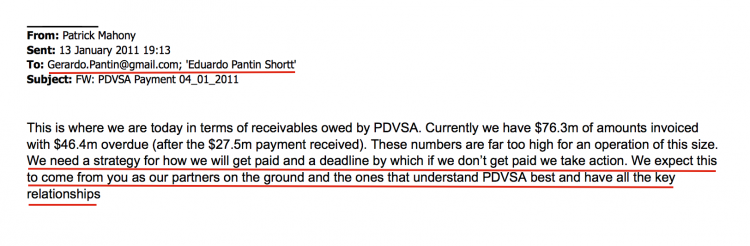

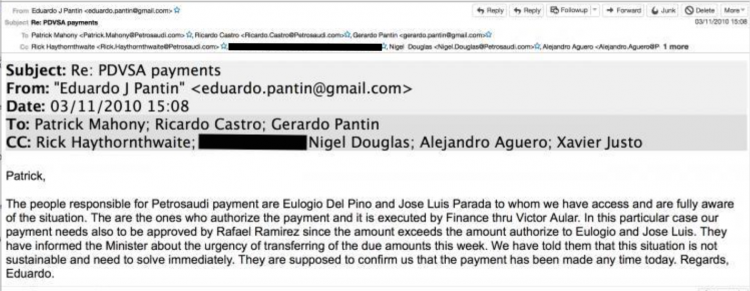

PetroSaudi correspondence on all these deals show clearly upon whom the company was relying to secure its interests in Venezuela. All correspondence was copied into the Pantin brothers Gerardo and Eduardo, major players in the oil business, and whenever trouble arose Mahony turned to them to sort it out:

“We need a strategy for how we will get paid …. We expect this from you as our partners on the ground and the ones that understand PDVSA best and have all the key relationships”

he told the Pantins as payments began to go awry in 2011:

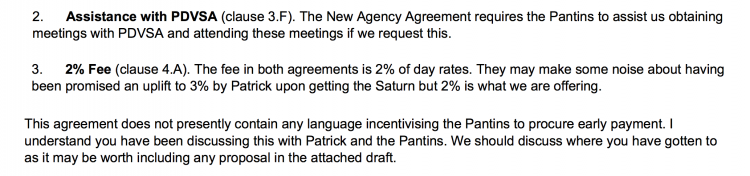

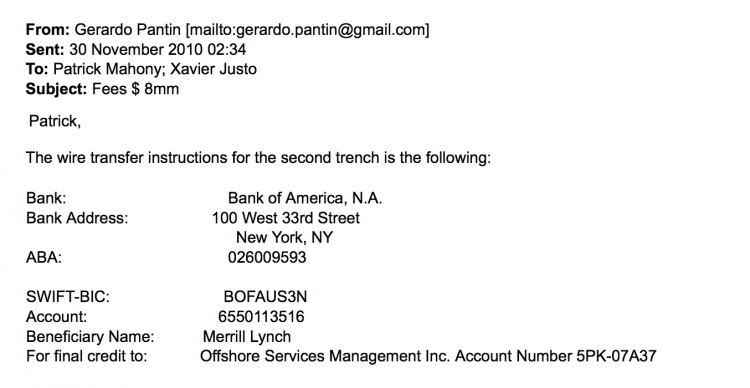

The Pantin brothers are in charge of a major family enterprise with a long history in the Venezuela oil business, who developed good contacts with the Chavez regime. Their company CPVEN was subcontracted to manage all the drilling work for the PetroSaudi adventurers (who had no clue how to run an oil operation). They were also hired as agents.

For their role as agents it was agreed the Pantins would receive 2% of the day operating rate from Discoverer and 3% of the day operating rate from Saturn.

There was also a deal to split the vast mobilisation fees that the Pantins extracted as upfront payments from the Venezuelans at the start of each operation. This fee should have been no more than $15 million to cover costs of the set up, however the Pantins organised $56 million to be paid in the case of Saturn, much of which was distributed back to local officials and contacts via banks in Panama, according to inside information from PetroSaudi.

The Pantin brothers themselves requested additional payments of $7 and $8 million to be paid through anonymous off-shore companies:

“Why are we paying this guy?”

If outsiders are left wondering over what justification there might be for such kickbacks, so apparently was PetroSaudi’s own shareholder Tarek Obaid.

“Why are we paying this guy 7 plus 8?”

he demanded of Patrick over the earlier Discoverer deal, which clearly utilised the same arrangement. “This is normal course of business payment, not related to the fee. The other payment is separate” replied Mahony:

“Subject: Re: SCA Wire Transfer Instrucctions

From: “Tarek Obaid” <[email protected]> Date: 28/01/2010 12:27

To: Patrick MahonyWhat is this for? I understood 120 PDVSA, 40 Neptune, 6.4 for Neptuna again, why are we paying this guy 7 plus plus another 8?

On 28/01/2010 13:16, “Patrick Mahony” <[email protected]> wrote:

This is normal course of business payment, not related to the fee. The other payment is separate – will send an email on that shortly”

However, the parties to this questionable deal clearly started to find their interests diverging at an early stage and problems with payments soon developed with PDVSA. It became evident that PetroSaudi’s boast that its ‘royal connections’ and ‘diplomatic clout’ would succeed in extracting hard currency from the Venezuelans where others could not was fantasy.

“The Saudi regal thing definitely worked to begin with” one insider has told Sarawak Report. “PetroSaudi executives were royally received at the Venezuelan Oil Ministry as if they were official representatives of the King of Saudi Arabia”.

There were hopes the PetroSaudi bid was an opening move towards a massive Saudi investment into Venezuelan oil extraction infrastructure, which in turn might bring further opportunities within Saudi Arabia, thanks to PetroSaudi’s pitch.

But, the lustre must have started to wear off almost immediately with the reality of the two lame duck, third hand ships PetroSaudi pitched up with and their clear limitations when it came to cash, once the up-front $120 million ‘investment’ had been made.

The Venezuelans started to drag their feet. In January 2011 Patrick was forced to write a frank email, explaining why PetroSaudi, agent of the Saudi Royal Family though it was, could not afford not to be paid:

I know you dismissed these matters as not being very important and only being small numbers in terms of what the relationship between PDVSA and PetroSaudi may become but this is unfortunately not the point…the numbers may be small in the grand scheme of the things we are discussing but in proportion to the size of this particular business, the outstanding receivables are very large (today $76m approximately) and it troubles us greatly that PDVSA, as such a large national oil company, is not able to make such small payments”.

he wrote plaintively.

Patrick Mahony <Patrick.Mahony@P etrosaudi.com>

Para 14/01/2011 01:47pm

<[email protected]>,

“[email protected]” <[email protected]>

cc Tarek Obaid <[email protected]>, Xavier Justo <[email protected]>, “[email protected]” <[email protected]>

Asunto Follow Up to NYC Meeting

Dear Eulogio and Fadi,

Happy New Year to you both. I hope you managed to have a good break.

I wanted to follow up on our meetings of NYC and specifically what is happening with the operations of the Discoverer and the Saturn. As we agreed in NYC, it was very important for us to finish 2010 with zero receivables outstanding from PDVSA so that we could avoid any problems with our bondholders. Unfortunately however this did not happen and we finished the year with almost $70m outstanding from PDVSA. This means we will have to report this to our bondholders when we report our full year results at the end of this month and this means we will put them in a position where they can take action against this business and this could put the entire operation at risk.

When we sat in NYC we discussed the importance of keeping the bondholders happy as this would not only allow us to go back to the debt market when we want to acquire more assets but also these are very large financial institutions that are important for both of us in the international

markets. Defaulting on these loans is something that would look very bad

for both of us and certainly make getting financing for any offshore equipment in Venezuela almost impossible – something neither of us would want if we are planning on growing this business. Furthermore, giving the bondholders reason to take action by not paying could have us end up in another Neptune situation, which we both should work very hard to avoid. We came together to solve the Neptune problem so we would be very foolish to create another Neptune problem only a year later when we can easily avoid it.

The lack of payment is also causing fears with our employees and could disrupt the operations further that way. Together with the fact that the Discoverer contract is coming to an end, we have some nervous personnel on the vessels and this could really hurt what are, by your own admission,

very successful operations today. You mentioned in NYC that you could write us something to reduce the concerns of our employees and show them that the Discoverer contract will be extended. Is this still something you plan on

doing? This would help greatly as we currently run the risk of losing many

good people if they feel a) the Discoverer contract will not be extended

and b) PDVSA is not paying us.

I know you dismissed these matters as not being very important and only being small numbers in terms of what the relationship between PDVSA and PetroSaudi may become but this is unfortunately not the point. Every business we invest in needs to operate independently and be profitable independently. This means that our offshore services business needs to be an independent business and we cannot mix it with what we do in upstream or CITGO with you. Also the numbers may be small in the grand scheme of the things we are discussing but in proportion to the size of this particular business, the outstanding receivables are very large (today $76m approximately) and it troubles us greatly that PDVSA, as such a large national oil company, is not able to make such small payments.

I would like to reiterate our commitment to work with you and PDVSA and our desire to expand our business relationship far beyond these two drillships, however the situation on our offshore business with you has come to a point where we may lose control of this operation due to PDVSA’s lack of payment and this would greatly undermine all of the potential future business we could do together. As you yourself said in NYC, operationally you are very happy with us so the only problem is really a lack of payment.

We will be in Caracas next week and would be happy to sit down and discuss the above with you, please let us know if any times are convenient for you.

I urge you to please attend to these matters so that we can focus on the more interesting and larger business propositions we discussed. Let’s not let our relationship or these operations go to waste over such small amounts.

I look forward to hearing from you.

But, as this email makes abundantly clear, by this stage the chaps in Venezuela had got the full measure of PetroSaudi and were teasing them over why they were worried about punctuality over the odd hundred million.

Both sides were belittling the money in the context of the ‘bigger sums available’, but who did Mahony think he was kidding?

By the end of 2011 Discoverer was out of action, Saturn was failing to impress and it seemed the Venezuelans had stopped paying altogether. By 2014 PetroSaudi’s role in the 1MDB affair had been made world news by Sarawak Report, the Oil Minister Rafael Ramirez was out of office and the top official in charge of the deal, Jose Luis Parada, was a wanted man.

“I think there was also anger in Venezuelan official circles at having been misled on the Royal thing by this company“, acknowledges one person close to the situation.

The Pantins also attempted to help, but apparently their fixing didn’t work:

PetroSaudi, it appears then decided to exercise their Letter of Credit in order to get back the $130 million agreed under the Saturn contract. That, at least, would have covered the company’s exposures and more.

Meanwhile, Prince Turki is no longer the son of the King of Saudi Arabia, since his father died in 2015 and he has pulled out of the company.

So, could the old schoolfriends Tarek Obaid and Patrick Mahony finally be about to face the consequences of their grandstanding and extraordinary string of deceptions, which has also included the framing and imprisonment of their former colleague and key whistleblower, Xaver Justo?

What is clear is that 1MDB’s gambled money has predictably disappeared as has been the case with so many of Mahony’s other reckless multi-million dollar investments using other people’s money. The future of PetroSaudi International, which is now several months late in filing its accounts at London’s Companies House seems to be teetering on the brink.