One of the places where the fugitive and top FBI criminal suspect, Jho Low, is still known to feel comfortable to visit is Thailand. He has been recently spotted living it up in what has become his accustomed style in 5 Star-plus hotels in Bangkok, presumably on what remains of the public money he stole from 1MDB.

Jho has a history of partying with well-connected and wealthy Thai friends. One particular coterie has appeared in numerous party pictures over the years, boasting for example a memorable ‘Double Count-down’ New Year’ event, which (thanks to Jho’s hospitality) they celebrated in both Sydney and Las Vegas by keeping ahead of the sun in a private jet.

According to onlookers of Jho’s recent nights out in Bangkok the extravagance has not diminished, so plainly he doesn’t plan to be the one to face any cutbacks in life-style thanks to the disastrous management of the fund.

Malaysia, meanwhile, faces another US$600 million payment to Abu Dhabi at the end of December thanks to these excesses and of course, there remain the loans of $6.5 billion plus interest to make good, apart from all the other borrowing.

Jho Low’s contacts with influential (ie rich) Thai families have enabled him to gain considerable protection and clout in that country that seems to have extended beyond a free passage. For example, the arrest of Xavier Justo and his imprisonment for 18 months over 1MDB was orchestrated by his former employers at PetroSaudi International, who were in turn to a large extent leaning on contacts provided by Jho Low, according to information received by Sarawak Report.

Phengphian Laogumnerd

Another example of Jho’s Thai ties was cited by the prosecution during one of Singapore’s recent 1MDB court cases, who referred to one of his key associates, another of his contacts apparently forged at Wharton Business School in Pennsylvania, namely Phengphian Laogumnerd:

“Earlier in the day, Tan [Singapore prosecutor] produced a flight manifest from June 4 last year for Low’s private jet from Shanghai to Hong Kong. That was part of the prosecution’s case to portray how close Yeo is to Low, despite his earlier attempts to say dealings were largely indirect and via people like Yak.

Besides Low and Yeo, there were six other passengers on the flight. They include Low’s girlfriend from Penang, Jesselyn Chuan Teik Ying; Tan; Yak; and former 1MDB staff Jasmine Loo Ai Swan, who was wanted by Malaysian authorities for 1MDB-related investigations.

There were also two other individuals: Kee Kok Thiam, and Laogumnerd Phengphian, a Thai national. Yeo said Phengphian might be Low’s classmate at Wharton Business School, and is supposedly a relative of Low.” [The Edge November 2016]

Friend Phengphian was clearly still happy, therefore, to rub shoulders with Jho Low and fugitives from Malaysia’s 1MDB investigations, such as Jasmine Loo, and also key BSI Bank personnel, who were later jailed for their part in money-laundering proceeds from 1MDB, during this luxury jet outing in mid-2015 at the height of the Malaysian task force investigations into the scandal.

A few months later, in November 2015, Phengphian Laogumnerd was himself producing column inches over in New York tabloids over a deal that seems remarkably similar to the various fire-sales that his friend Jho was also making at that tricky time. Laogumnerd made a quick-turnaround, loss-making disposal of one of the city’s most expensive apartments just a year after he had bought it:

“an apartment at 15 Central Park West has just sold at a $3 million loss for $45 million, according to city property records.

The seller, a Chicago based LLC, bought the 18th floor duplex for $48 million last year..

The Chicago based LLC was signed by Phengphian Laogumnerd, who is the manager of Thailand-based information technology contractor Songkhla Finishing Co. [New York Post]

Laogumnerd in fact owned the flat through a New Zealand company, which was also a favoured device of Jho Low and his family, who placed so many of their assets in a New Zealand-based trusts at the time. Likewise, Jho’s fellow 1MDB conspirator Khadem Al Qubaisi.

Maybe, friend Jho had advised Laogumnerd that this was a sensible method of owning US properties? It seems possible since the incorporation address of the company under which the Thai multi-millionaire property owner held his flat (15Cpw Phb Ptc (Nyc) Limited) was none other than that of Jho Low’s own legal advisor at the time, the company Cone Marshall at 18 Stanley Street, Auckland, NZ:

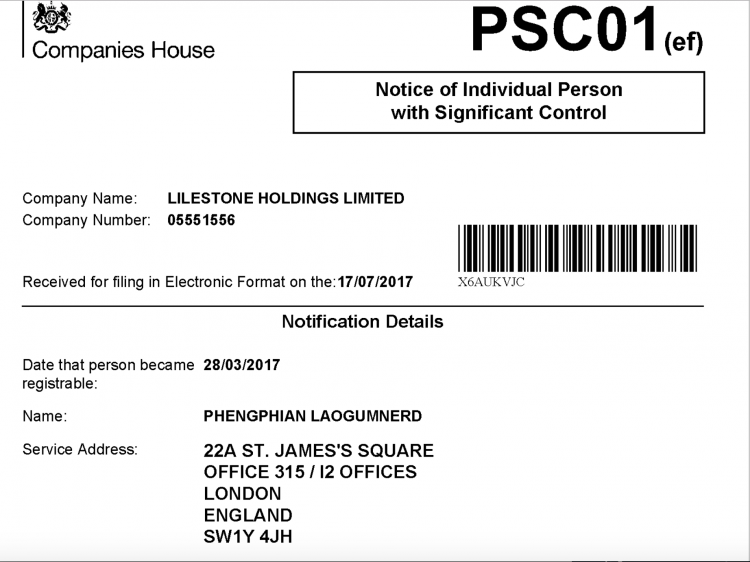

Having released such a large sum, Laogumnerd, who runs a software contractor, Songkhla Finishing and has recently become involved in venture capital in Indonesia, seems to have continued to have no personal scruples about keeping on doing business with his pal/relative on the run, because company records in the UK show that it was he who has now taken over the ownership and control of the Myla Underwear company.

Department of Justice court papers have now confirmed that Jho Low originally bought Myla with money taken from 1MDB, which he had headquarted in a Mayfair property in Stratton Street – one of three properties he bought in a row for over a hundred million pounds, also stolen from 1MDB.

Department of Justice court papers have now confirmed that Jho Low originally bought Myla with money taken from 1MDB, which he had headquarted in a Mayfair property in Stratton Street – one of three properties he bought in a row for over a hundred million pounds, also stolen from 1MDB.

He and his family are resisting the sequestration of this and other properties now held in a trust in the Cayman Islands.

Meanwhile, none other than Phengphian Laogumnerd has now been registered as of February of this year as effectively the new owner of Myla’s parent company Lilestone Holdings Ltd in the capacity of an ‘individual person with significant control’, defined as someone with over 75% of the shares and the capacity to hire and fire directors and the Board.

Jho has transferred this company into the ownership of someone he plainly trusts, but under what form of agreement is unclear:

Chairman of a Bank!

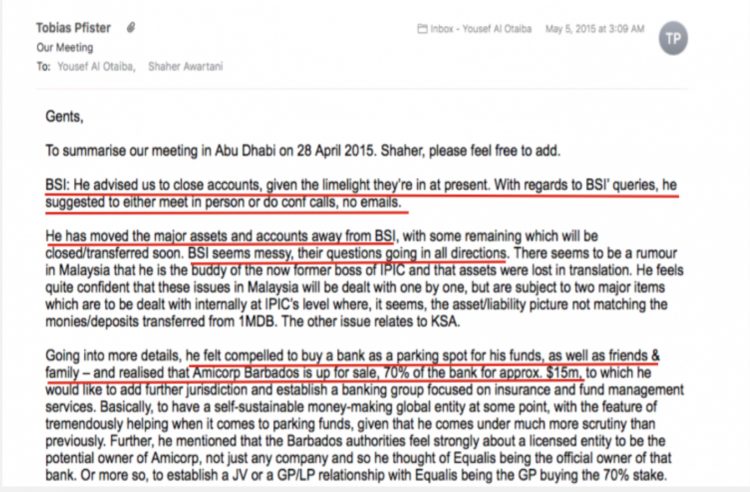

Readers of Sarawak Report will recall that in May 2015, just as the heat was really cranking up on 1MDB and on his conspirators at BSI Bank, Jho Low had mooted to Abu Dhabi’s US Ambassador and business partner, Sheikh Yousef Otaiba, that he needed to purchase his own bank to handle all the money he was funelling through the system (money stolen from 1MDB).

Jho was at the time looking at a Barbados off-shore institution as the perfect vehicle, according to Otaiba’s Swiss banker Tobias Pfister, who reported that Jho now “felt compelled to buy a bank as a parking spot for his funds, as well as his friends and family”. Jho was looking at Amicorp Barbados which was 70% up for sale for $15 million:

Otaiba was recommended not to get involved, since “it is one of the most regulated of industries”.

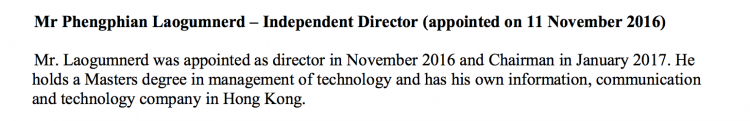

However, it seems that Jho’s young friend Laogumnerd was not deterred by the idea of getting into the line of business himself. Perhaps inspired by Low he has taken over another off-shore bank, Century Banking Corporation in Mauritius, becoming a director in November 2016 and Chairman in February of this year.

Surprisingly, given that Phengphiang Laogumnerd is Thai, he has chosen to put himself at the head of the island’s first and only Islamic bank:

A number of key personnel at the bank appear to have Malaysian connections. So, we trust that Mr Laogumnerd’s continuing friendship and association with his pal Jho Low has not extended to housing any of his illicit money in his new off-shore Islamic bank!