Back in 2016 Jho Low was fire-selling paintings to raise multi-million dollar loans at a time most banks would not touch him as a client. Sarawak Report wrote about the calls to regulate that flow (below).

Six years later it seems little has changed and the top auction houses are still advertising their services for providing access to quick money without the normal scrutiny of the financial service industries. This and other money-laundering topics will be under discussion tomorrow during this ACAMS debate.

*********************

[April 2016] Quintessentially British, yesterworld and exceedingly posh – that is how the top UK based auctioneers position their image and it has worked very well in propelling a once down-market trade, flogging second hand goods, into a gilt edged profession, dealing in billions.

But, in the process, it appears, some of these top global players have ventured into the very different trade of lending money – for example, Sotheby’s Financial Services, which has emerged as a key lender to Malaysian financier Jho Low.

We therefore ask whether, by mixing the two, such institutions are also being utilised in a third capacity – that of an up-market laundering service?

Multi-million dollar loans to Jho Low from Sotheby’s

As with so many other leading institutions, ranging from the UN Foundation to top global banks, the 1MDB spotlight has shone unwelcome light into some discreetly shaded places of the art world, in pursuit of the antics of Jho Taek Low, who has been buying and then selling paintings like billy-o, ever since he parted 1MDB from over a billion dollars of its development money.

He has also, according to Bloomberg, been raising loans from none other than Sotheby’s to the tune of hundreds of millions of dollars, using some of those paintings as collateral.

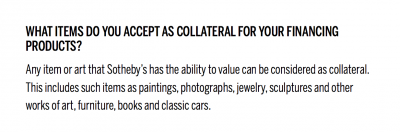

Our research shows that Sotheby’s does indeed boast this service, which it claims is unique. The firm details how it has provided no less than US$4 billion in loans to its valued customers to date and recommends its loan service for being unrivalled in the speed with which they can provide the money – and for it’s utmost confidentiality, of course:

Sotheby’s are not shy in putting forward the advantages of their money services over and above other more conventional institutions. In particular, they recommend the “unmatched speed” of their loans and total discretion.

So, what are the standards of due diligence, compared to banks, in ascertaining the origin of these secret cash investments and how closely are these being regulated?

Is it easier, for example, to purchase a US$100 million dollar Picasso than it is to open a US$100 million dollar account at a high street bank, in terms of checking where that money came from?

Of course, once a painting has been bought and sold, any bank would be happy to open an account with a cheque from a reputable auction house from the proceeds of a sale of some over-price piece of modern art….. so, surely, the standard of financial regulation in the art world MUST have to be every bit as stringent as that of banks?

But, in which case, how come Sotheby’s are beating the competitive money-markets when it comes to the speed of providing money? Sotheby’s explain it as follows:

“..because of Sotheby’s global reach and deep knowledge of the art market, Jan’s [Prasens] group can streamline the diligence process and get deals done with remarkable efficiency.” [Sotheby’s Financial Services, testimonials]

Ah! So, deep knowledge of the art market enables “remarkable efficiency” and “unmatched speed” in the diligence process surrounding these big loans – does this include financial due diligence into their customers or just the provenance of the artwork?

Apparently not, as Southeby’s Financial Services promote their loans on the very basis there is no need to examine the background to the cash – how conveniently ‘rapid’:

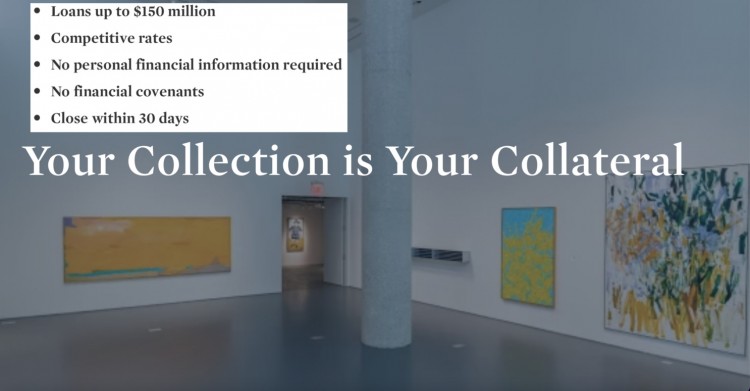

SFS can quickly and accurately value your collection, using it as collateral to provide individualized financing ranging from $2 million to $150 million. And because all SFS loans are underwritten by art and not personal wealth, no financial information or covenants are required, and closings are usually completed in less than 30 days. [Sotheby’s Financial Services]

We are not, of course, the first to ask such questions about the art market in general with respect to big buyers of dubious origin like Low. Below is how some experts have answered them, for example Professor Roubini of the Stern School, New York, last year in Davos, where the role of the art market as a money-laundering device was discussed as a pressing global problem:

“Whether we like it or not, art is used for tax avoidance and evasion,” said Prof Roubini, himself an art collector. “It can be used for money laundering. You can buy something for half a million, not show a passport, and ship it. Plenty of people are using it for laundering.” [Financial Times]

Oh really?!

Detailing Jho Low’s activities, Bloomberg has explained one way it can be done. A buyer, it appears, can produce his artwork as a collateral for a loan, on the understanding there will be a sale if the loan is not repaid.

“Now Low is once again creating buzz in the art world. Since Feb. 3, he has sold works by Claude Monet, Pablo Picasso and Jean-Michel Basquiat, according to three people familiar with the matter. They fetched about $54 million, with unusually steep losses on at least two pieces.

The artworks consigned by Low were among the top lots at Sotheby’s evening auction of Impressionist, modern and contemporary art in London this month. All three had been pledged as part of the collateral for a loan of about $100 million from Sotheby’s Financial Services, two of the people said, asking not to be named because the information is private”

We contacted Sotheby’s to ask what checks would be done and by whom on the origin of money used to buy paintings, such as in the case of Low?

And we will publish their answers once they arrive [six years later we have received no reply].

Update – Project Cheetah:

A few months later when the US Department of Justice published their asset seizure filings against Jho Low they detailed Southeby’s correspondence on the matter:

On March 20, 2014, a Sotheby’s Financial executive (“Sotheby’s Executive 1”) emailed his colleagues at Sotheby’s explaining his dealings with LOW. The email reads in relevant part that:

“Just wanted to bring you up to speed on the big loan opportunity. . . [The borrower] doesn’t want us to use his name in our communications, he wants to be referred to as ‘the client’ and we will refer to this transaction as project Cheetah (referring to the speed at which we are trying to move).

Confidentiality is absolutely critical to him. I’ve been having multiple calls with him and his lawyers on the structure as he will most likely want to use a Cayman/BVI entity as a borrower but keep the ownership and pledge the artwork for the debt of the company plus personally guarantee it. . . . While he didn’t tell me himself, his lawyers indicated he is using the money to buy a yacht.”

This would appear to have been the sum total of the due diligence on the matter, the paintings having been originally bought, several through auctions at Christies, using money stolen from the 1MDB Goldman Sachs bond issues and passed to the Tanore Finance Corporation (BVI) company ‘owned’ by Eric Tan.

Tan had then told Christies he had ‘gifted’ the paintings to Jho Low, which the auctioneers accepted. The paintings would later be sold off at a huge discount by Southeby’s to pay back the loan that Jho Low never honoured.

To verify the ownership of the paintings Tan produced several letters explaining his ‘gift’ which the Department of Justice filings say were presented to Southeby’s as proof of ownership. These letters were apparently considered acceptable by the auction house and were cited by the DOJ:

Each letter included representations from TAN that he is the “sole 100% beneficial owner of TANORE FINANCE CORP,” and that he is “the legal and beneficial owner of all the art-work(s) mentioned in this gift letter.”

The body of each letter also states:

I wish to gift you ALL of the art-work(s) mentioned in this gift letter in consideration of the followings [sic]:all the generosity, support and trust that you have shared with me over the course of our friendship, especially during the difficult periods of my life; and

your continuous generosity in providing charitable contributions to advance the well-being and development of our global communities; and

your passion in promoting the understanding and appreciation of art- works.

Each gift letter closes by stating:

All the art-work(s) gifted to you should not in any event be construed as an act of corruption since this is against the Company and/or my principles and I personally do not encourage such practices in any manner whatsoever. The gift(s) is/are merely a token of appreciation and I am hoping that the gift(s) to you would encourage you to continue with your good work globally. [Dept Justice Asset Seizure Filing]