NGOs have called foul on a secretive multi-million dollar loan from the Asian Development Bank, which the Sarawak Governor, Taib Mahmud, clearly plans to pocket himself.

They complain that this latest scandal, involving the so-called SCORE (Sarawak Corridor Of ‘Renewable’ Energy) project, is particularly shocking, because it violates the core principles of an agency that is supposed to alleviate poverty, not to help Asia’s richest to get richer.

The RM145million (US$45million ) loan is being petitioned by Sarawak Energy Berhad in order to fund the so-called Mambong to Kalimantan transmission cable, designed to carry electricity from its controversial hydropower projects across the border into sparsely populated jungle in Kalimantan.

It is being justified by the ADB under its sustainable energy and development programmes.

But, with just 45km of distance to be covered, the loan works out at a staggering $1million dollars a kilometre.

And, as investment analysts have been clearly pointing out, there can be little doubt who stands to gain most from this project, with shares already soaring on Sarawak Cable, the company directed and largely owned by Taib’s elder son Abu Bekir.

Sarawak Cable has already been handed the lion’s share of transmission projects in SCORE and the speculation is universal that the 45km Mambong-Kalimantan line will be handed to the company as well. According to AMResearch:

“Sarawak Cable is also eyeing a number of smaller transmission jobs with a potential total value of RM400mil. This includes the Tanjung Manis-Bintulu and Mambong-Kalimantan lines.”[AM Research Revises Up Sarawak Cable Earnings 2013]

Likewise, the Borneo Post has said:

“Sarawak Cable can now look forward to two more projects that might be awarded in the near term, including the Tanjung Manis-Bintulu and Manbong-Kalimantan lines worth an estimated RM400 million”[Borneo Post]

This week some 40 NGOs, led by International Rivers, Bruno Manser Fund, JOAS and Sarawak’s anti-dam group Save Rivers protested, therefore, that the loan violates ADB’s integrity principles and should be withheld:

“The loan is to be issued to SEB, a company that has a systematic record of corruption… Over the past six years, contracts worth US $400 million have been awarded by SEB to companies linked to Taib’s family, including Sarawak Cable, Naim Holdings and Cahya Mata Sarawak, despite not offering the most competitive bids. According to the ADB’s Integrity Principles and Guidelines (2012), such conflicts of interest in the procurement process would constitute acts of corruption” [NGO Statement]

The NGOs are further pointing out that the destructive impact of SCORE has obliterated vast tracks of jungle; displaced and impoverished vulnerable communities and is causing severe methane emissions.

This makes a nonsense of the sustainability and development claims, so they say that the entire project must be urgently reviewed by the bank.

Privatised into Taib family ownership

Taib Mahmud has famously claimed that his family “do no business in Sarawak”.

Yet, in fact, his companies control almost every aspect of business in the state, commanding the lion’s share of all public contracts, as everybody knows.

Sarawak Cable is just the latest of a series of major business concerns, which have been built up through a well-established pattern of so-called ‘privatisations’ of state assets into the family’s own hands.

The main purpose of the company is to absorb the profits from the massive publicly-funded cabling contracts linked to SCORE.

These ‘privatisations’ were masterminded by Taib himself, who notoriously abused his combined capacity as the chief minister, finance minister and resource minister of Sarawak, to pass valuable state assets into the clutches of his own family.

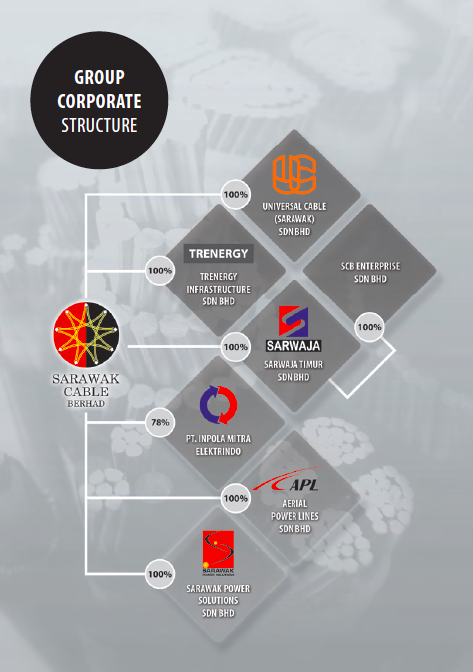

Thus, in 2009, when Taib started to push through the early stages of his grandiose hydropower projects, he set about building up Sarawak Cable (till then a dormant company) by muscling acquisitions in established concerns, including Universal Cable Sarawak and Leader Universal, over which he then positioned his son with a majority ownership.

Abu Bekir now holds a 42% share of Sarawak Cable, in contravention of Bursa Malaysia rules, which are that no single shareholder may own more than 33% of a public company.

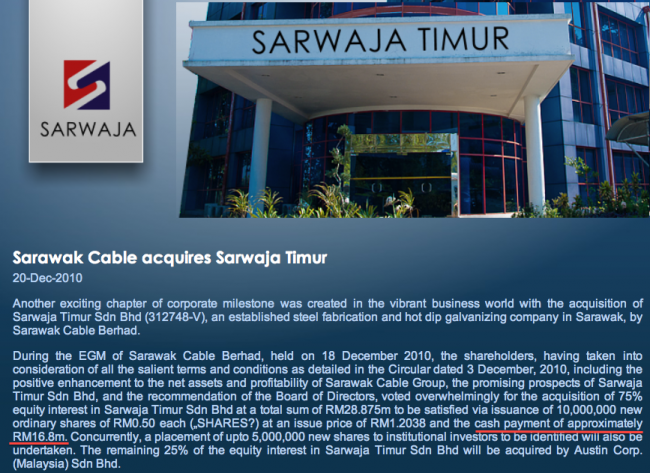

Then, in 2010, Taib “privatised” the cable manufacturing arm of the publicly owned Sarawak Energy, Sarwaja Timur, into the hands of Sarawak Cable, just in advance of a series of multi-million ringgit transmission line contracts under his own SCORE programme.

Taib, as the minister in charge, clearly knew that hundreds of millions of ringgit were due to be awarded to Sarwaja Timur under the SCORE programme.

Therefore, he should be asked why did he sell this company on behalf of the state to his son for a mere RM16million?

As a result of this transaction, in which Taib was entrusted with representing the interests of the state, hundreds of millions of ringgit in profits have been diverted from from the public purse to his son’s company.

Meanwhile, Sarawak Cable’s other major acquisition, Trenergy Infrastructure Sdn Bhd (majority shareholder Abu Bekir Taib) has scooped up most of the remaining contracts, despite opposition politicians pointing out that cheaper and better bids had been offered by other more experienced companies.

Indeed, Sarawak Cable has been awarded nearly all the transmission line projects linked to SCORE so far, and investment commentators agree that these profits are clearly linked to the company’s political connections.

They have also pointed out that Taib’s successor, his brother in law, Adenan Satem, has allowed him to continue “business as usual” with the SCORE plan, over which Taib still clearly has charge.

Last year the company AMResearch was widely quoted recommending that investors put their money in Sarawak Cable for these very reasons of political influence, which are by definition corrupted:

“Sarawak Cable is an interesting possibility to consider for those inclined to put their money in this sector…any discussion on Sarawak Cable is remiss without considering the fast-developing Sarawak Corridor of Renewable Energy (SCORE)…..the ongoing progress of SCORE is encouraging for Sarawak Cable given its political connections.

It is worth noting that in addition to former chief minister Abdul Taib Mahmud’s son Mahmud Abu Bekir as chairman of Sarawak Cable, the chairman of Sarawak Energy, Abdul Hamed Sepawi, is Abdul Taib’s cousin.

Furthermore the transition to a new chief minister for the state earlier this year had seen overall policy continuity and this means business as usual for the various public-listed companies linked to former chief minister Abdul Taib Mahmud’s family — Sarawak Cable included” [Kinibiz – investment advice to buy into Sarawak Cable]

Helicoptering in more profits?

Sarawak Report has now identified further manoeuvring by the Taibs, which raises questions over the funding of helicopters, which have just been acquired by Sarawak Cable in a deal that appears to implicate Chairman Abu Bekir Taib as a middle man for the project about to be funded by the Asian Development Bank.

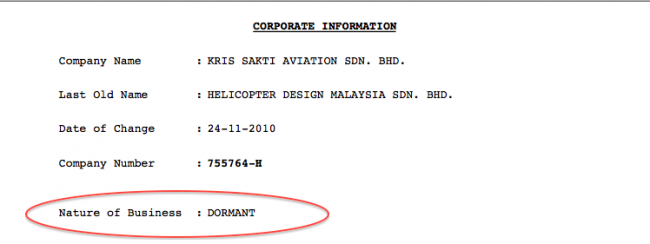

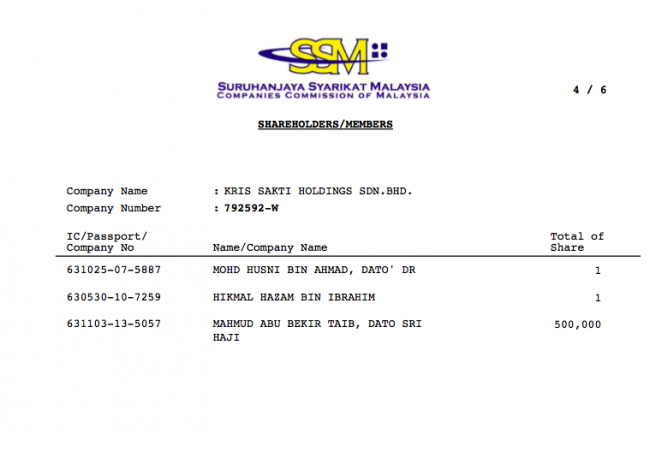

We have established that shortly after Sarawak Cable was activated from being a dormant company in 2009, another ‘dormant company’ was set up by Abu Bekir, named Kris Sakti Aviation Sdn Bhd.

This company is in turn owned by Kris Sakti Holdings, which also controls a number of other companies, including Kris Sakti Petrolium Sdn Bhd and Kris Sakti Techologies Sdn Bhd, all owned by Abu Bekir Taib.

Yet, despite being registered as a ‘dormant company’, Kris Sakti Aviation (formerly Helicopter Design Malaysia Sdn Bhd) boasts a major range of business activities on its website, claiming numerous activities and areas of expertise such as:

“a certified heliport consultant and Sole Exclusive Agent for South East Asia .. established in 2009 to provide specialist services to a set of clientele in the area of Consulting, Advanced Technology, Surface Heliports, Rooftop Helipads, Offshore Helidecks and Private Airports…”

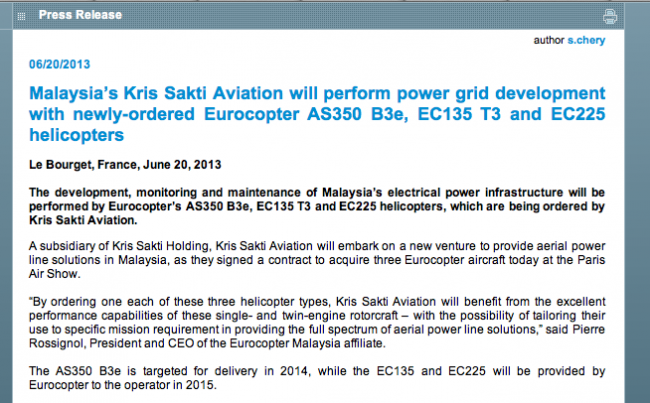

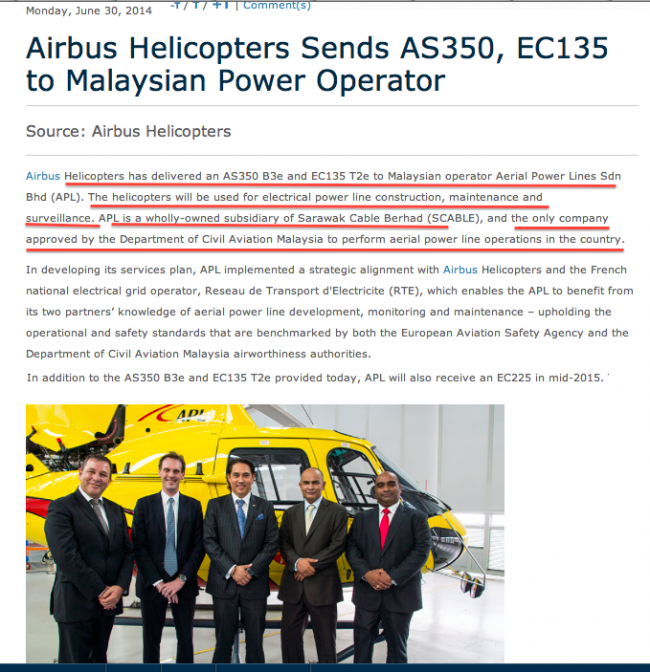

In June last year this ‘dormant company’ dazzled onlookers at the Paris Air Show by ordering 3 industrial helicopters “for an undisclosed price”.

The purchase was widely reported, including in the Taib family owned Newspaper, The New Sarawak Tribune, which handily detailed the helicopters as an “AS350 B3e Ecureuil, an EC135 T3 and the latest in the Super Puma family, the 11 ton EC225”.

Sarawak Tribune also explained that the key use to which these helicopters could be put was “in the field of power lines construction, maintenance and surveillance”

And, Kris Sakti Aviation’s own website relays another article, explaining Abu Bekir’s ambitions in power line operations”:

“Kris Sakti Holdings Sdn Bhd chairman Datuk Seri Mahmud Abu Bekir Taib .. son of Sarawak Chief Minister Tan Sri Taib Mahmud, said KSA, which will be the pioneer in aerial power line operations, aims to be the leading solutions provider for power line operations in Malaysia and Southeast Asia. [Kris Sakti Aviation]

Middleman?

Yet, a year later in 2014 it appears that it is not Abu Bekir’s private dormant company, but the publicly listed Sarawak Cable that has in fact taken delivery of the exact same helicopters, with the third Puma still expected for delivery in 2015.

The down-payment, according to Sarawak Cable’s 2013 Annual Report, was RM26million.

The purchase by Sarawak Cable was made through its wholly owned subsidiary Aerial Power Lines Sdn Bhd, according to the reports. This company was acquired in September 2013, shortly following the order by Kris Sakti of the three helicopters.

So, was Kris Sakti merely a profitable middleman for these helicopters, owned by Abu Bekir Taib? If so, why is this not fully declared, along with the commission paid by his Dad on behalf of the people of Sarawak?

There is a further significant detail, relating to the projected ADB loan. The company press release issued by the French manufacturer Airbus notes that Aerial Power Lines is the only company approved by the Department of Civil Aviation Malaysia to perform aerial power line operations in the country. So, if helicopters are to be involved in the installation of the proposed Mambong-Kalimantan transmission line, then only Sarawak Cable will be in a position to install them.

This follows another familiar pattern in the way that Taib has built up his family’s wealth. It was again his own family company Sarawak Securities that was able to thrive in the early 1990s as the only company issued with a license to sell stocks and shares in Sarawak.

Clarification demanded over Abu Bekir’s private interest in helicopter purchase

This series of confusing manoeuvres between the private and public companies directed by Taib’s son in the purchase of these helicopters demands full explanation, in advance of any international ‘development loan’ by the Asian Development Bank.

Why, for example, did Abu Bekir buy 3 helicopters when his private dormant company held no licence to perform aerial power line operations, even though this was the publicly stated purpose of the purchase, as recorded in his own family newspaper?

Furthermore, given that this is deal bears all the hallmarks of a related party transaction between a private company owned by Bekir and a public company controlled by Bekir, why have the full financial details not been made public, as is required by law?

Instead, Kris Sakti’s own website announces that the cost of the helicopters to them is not disclosed.

And, in a final intriguing twist, we point to the continuing confusion that appears to exist over which company is actually controlling the purchase of the 3 helicopters.

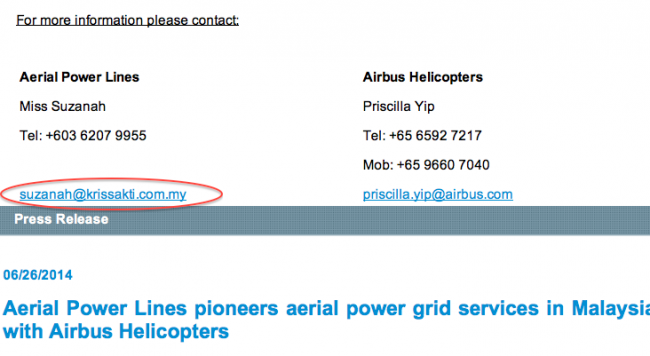

After all, the press release by France’s Airbus Industries is co-sponsored not by an employee of the advertised purchaser of the helicopters, which is Sarawak Cable/Aerial Power Lines, but by a lady called Miss Suzanah.

Yet, Miss Suzanah’s email address reveals that she is employed not by Sarawak Cable/ Aerial Power Lines but by Kris Sakti!

With the wrong company’s finger prints on this announcement, how can there be any further doubt that the three identical helicopters that were ordered by Kris Sakti last year are the same three helicopters being taken delivery of by Sarawak Cable this year?

If so, why has it not been declared and the payments made open to shareholders, as is required in all such related party transactions involving company directors?

Even though it is yet to be publicly admitted either by Sarawak Cable or the Sarawak State Government, the obvious assumption that this politically connected company expects to be awarded the as yet un-tendered contract to be financed by the ADB funded loan to SEB.

By engaging in the notorious and corrupted world of Taib Mahmud’s Sarawak the Asian Development Bank has thus already become enmeshed in a murky tale concerning conflicts of interest, lack of transparency and missing millions.

The Asian Development Bank would therefore do well to heed the concerns expressed by NGOs this week and review this over-priced and questionable project.