Sarawak Report has received more leaked documents relating to 1MDB. They give details of receipts and payments made by 1MDB and related companies between 2009 and 2015.

The first outstanding feature of 1MDB’s bank transactions during this period is the relative inactivity of what was presented to the nation as a busy public fund, investing billions raised on behalf of the state. Certain payments and receipts stick out, however, and Malaysians would doubtless be grateful if the parties involved could provide an explanation.

College Fees Abroad

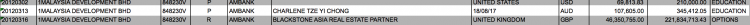

For reasons that are not entirely clear, the foreign college fees of two students were covered directly by 1MDB, according to the data. One was for the daughter of a Sabah BN politician, Edmund Chong Ket Wah, who had tragically died in a road accident. Persuading his wife to run for the seat, which she won on a sympathy vote for the BN-allied PBS party in Batu Sapi, was seen as a coup for Najib in 2010. But, why was 1MDB apparently paying for her elder daughter’s Australian education in 2012?

According to the statement obtained by Sarawak Report 1MDB paid Charlene Tze Yi Chong AUS$107,605/ RM345,41205 for ‘Education’ expenses on 13th March 2013.

Sarawak Report asks why was 1MDB directly paying for the education of a government-friendly politician’s daughter, since, inevitably people will ask whether this was part of the inducement to encourage a widow to run for her husband’s former office on a public sympathy vote in what was considered at the time to be a crucial by-election for Najib?

If so, 1MDB’s established reputation as a giant slush fund for the Prime Minister gains another example.

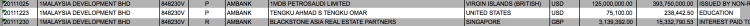

There was another even larger ‘Education’ pay out by 1MDB over the same period, consisting of several payments over many years to a titled student in the United States named Tengku Ahmad S Tengku Omar. Under the auspices of ‘Education’ Tengku Ahmad received similar payments for what appear to be extraordinarily high fees, even for the United States. On top of these payments the Tengku also received further payments under the auspices of ‘Grants & Gifts’. On 5th November 2012 he received US$68,571 (RM210,000) and on 22nd January 2013 another US$68,284 for these grants and gifts:

![]() The Tengku also received further regular payments that appear to be for fees, under the title of ‘Education’, for example on 23rd December 2011 US$75,100 was paid for his ‘Education’:

The Tengku also received further regular payments that appear to be for fees, under the title of ‘Education’, for example on 23rd December 2011 US$75,100 was paid for his ‘Education’:

Altogether Sarawak Report has identified ten payments to the Tengku either for ‘Education’ or ‘Grants & Gifts’ between 2011-2014, the majority being paid in current dollar equivalents to a regular sum of RM210,000 totalling US$673,000 (RM2.2m).

1MDB has advertised its support of various education grants, but perhaps a little more could be heard or known about these special 1MDB proteges and why these particular students were receiving so much direct support from the development fund for their foreign educations?

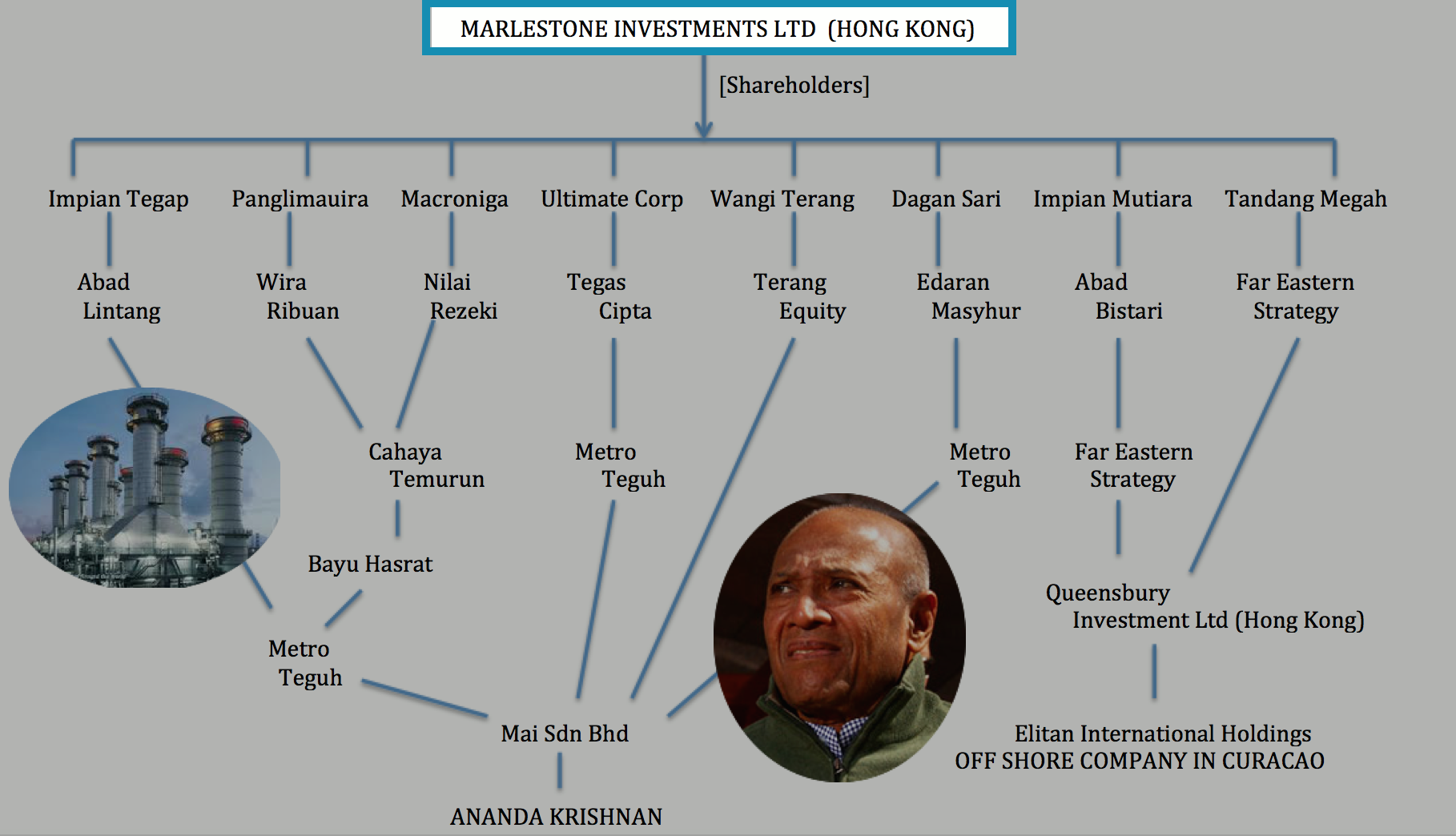

Payments from Ananda Krishnan’s Marlestone Investments

Considerable mystery still surrounds the so-called Power Purchase acquisitions made by 1MDB in 2012, which were guaranteed by Abu Dhabi’s IPIC fund.

The US$6.5 billion raised in two separate bond issues managed by the bank Goldman Sachs are, of course, the subject of considerable scandal, now that the Dept of Justice in the United States has confirmed Sarawak Report’s original reporting of corrupt payments.

Most of that money was stolen by Jho Low and his collaborators and much of it ended up in accounts controlled by Najib and his step-son Riza Aziz, say FBI investigators, who have announced they are pursuing criminal investigation into this and other aspects of 1MDB’s missing billions.

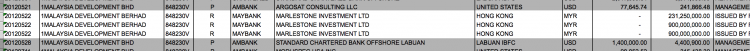

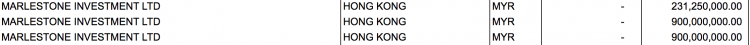

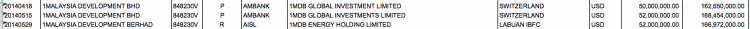

However, the latest leaked material from 1MDB’s accounts focuses on issues that have long been central to questions about the power purchase bonds, because they reveal three very large payments that were made 22nd May 2012 by a BN business crony, tycoon Ananda Krishnan, to 1MDB, which ought to be explained:

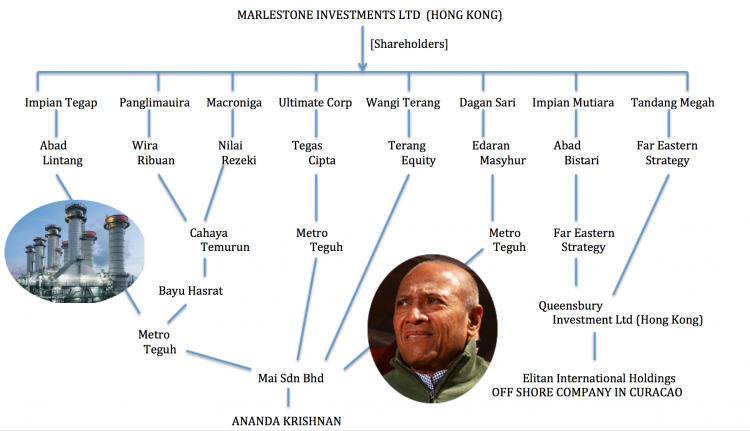

The three payments were made from the Hong Kong based Marlestone Investments, which Sarawak Report has ascertained is owned by Ananda Krishnan through a highly elaborate web of Malaysian and Curacao companies (see below).

The payments total RM2.031 billion and were made on 22nd May, just four days after the bond was raised by 1MDB to pay Ananda for his Tanjong Energy Group, through the first Power Purchase bond dated May 18th 2012.

Mysterious Power Purchase Bonds of 2012

Goldman Sachs had tried to keep the two 2012 record-breaking Power-Purchase bonds (of which this was the first) out of the public eye, market commentators noted. However details had emerged, showing that the rate of interest was remarkably high for investors.

Financial professionals were equally baffled as to why the bond was being unnecessarily guaranteed by IPIC? It has been later established that the unusual structure was primarily a ruse to enable Jho Low and his collaborators Khadem Al Qubaisi, the CEO of IPIC and Mohamed Al Husseiny, the CEO of Aabar, to siphon out most of the cash.

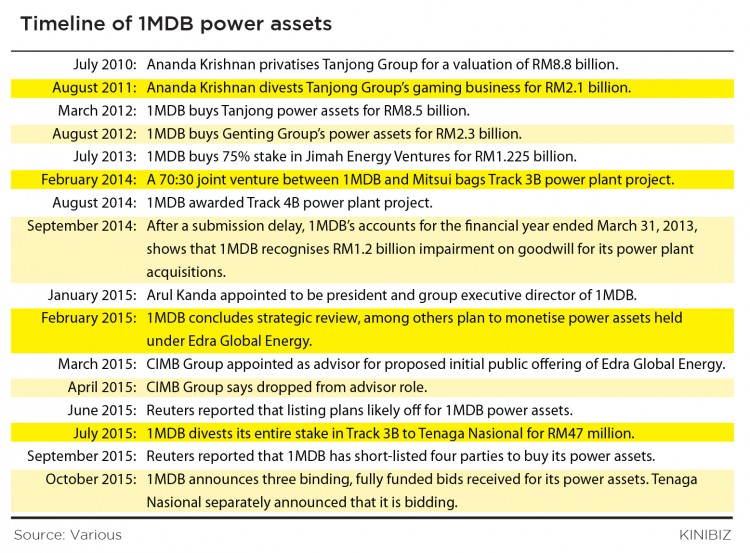

At the centre of this first bond issue was the tycoon Ananda Krishnan, who sold his energy group Tanjong Energy to 1MDB in May 2012, for a price that most experts considered was around RM2 billion more than it was actually worth!

The RM2 billion ‘Excess’ Is Discovered At Last?

Observers have noted that Ananda Krishnan had privatised the Tanjong Group in 2010 for RM8.8 billion. The price at which he sold teh energy section on to 1MDB in March 2012 was RM8.5 billion. However, this was crucially after he had hived off the lucrative gambling side of the original business, which he had sold for RM2.1 billion in 2011, plus other non-power sides of the group.

Moreover, over two years the power-generators would also have depreciated in value:

In theory, therefore, 1MDB appear to have over-paid by some RM2 billion for the Tanjong Energy assets – or as Kini Biz has calculated:

“Simple arithmetic meant the power assets under Tanjong must have been less than RM6.7 billion in value and closer to RM6 billion as Tanjong had other assets besides gaming and power, compared to what 1MDB paid.

In other words, for its first acquisition 1MDB would have overpaid by at least RM1.8 billion and by as much as RM2.5 billion.” [Kinibiz]

This discrepancy has remained a mystery. So, now that the new data has been revealed from 1MDB’s accounts showing that Ananda apparently paid back a virtually identical sum to the alleged excess paid for his company, Sarawak Report feels entitled to ask if the two transactions are connected?

Why did 1MDB appear to pay over RM2 billion over the going rate for Tanjong Energy, only to have the money appear to be serreptitiously returned in these below radar payments from a Hong Kong owned company controlled by Krishan, just days after making him that excess payment?

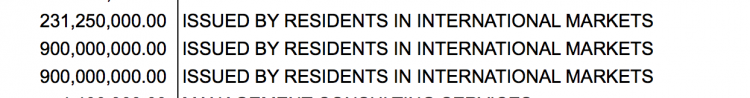

In the bank data the “purpose of the payments” from Marlestone were all categorised as being “issued by residents in international markets”, which can only be described as vague:

Given these somewhat baffling circumstances Sarawak Report thinks it only fair to enquire whether there might be a connection with other mystery activities linked to 1MDB’s balance sheets?

For example, it is now established, thanks to the money trails detailed by the Department of Justice Court filings in the United States, that Sarawak Report was correct in calculating that at least US$1.83 billion was stolen from 1MDB’s original ‘joint venture’ with PetroSaudi between 2009-11 and that the claim by the Malaysian development fund to have cashed in its stake in 2012 for US$2.03 billion was a sham.

That supposed profit was supposedly all invested in a Cayman Island ‘Segregated Portfolio’, then soon cashed in again and allegedly banked in 1MDB’s ‘Brazen Sky’ account in BSI Bank in Singapore, late 2012.

However, the various global investigations and court cases in Singapore over recent months have confirmed the suspicion that this entire story was bogus. That there was very little actual cash left over from the PetroSaudi joint venture deal for any kind of investment anywhere is now accepted to be the case by all credible and independent observers the world over and is only contested by cornered executives at 1MDB, Najib himself and a handful of his more die-hard loyalist political allies.

Kickback?

So, was Ananda Krishnan’s RM2.03 billion ‘post-deal return payment’ to 1MDB merely a way of quietly injecting some much-needed cash back into the company to help pay off its various mounting debts and interest repayments?

If so, was this payment from Marlestone then perhaps misleadingly ascribed to sources other than Ananda Krishnan and attributed, for example, to the cashing in of PetroSaudi ‘notes’ from the Caymans?

If so, it will not be the first time that 1MDB has been caught bamboozling its accountants with complex ’round-tripping’ exercises to cover yawning gaps in its balance sheets, for which a number of banks including UBS have now been fined for facilitating over the years. If there is another reason, Sarawak Report and many others will be pleased to hear it.

Shunting on the Money?

Meanwhile, it is worth noting that following Ananda’s big payments into the 1MDB account, various payments were made on to other entities within the 1MDB group in 2013 an 2014:

The shifting of finances recorded between the different branches of 1MDB, as traced through this account, are complex between 2012-14. However, if Mr Krishnan (who remains in Malaysia at PM Najib’s behest as a fugitive from an Indian extradition warrant over the Maxis fraud case) were able to explain his mystery RM2.03 billion payment in May 2012 back to 1MDB, then much of the puzzle might be clarified.

See the full Financial Times article on the Tanjong Bond from 2012 below:

1MDB of Malaysia’s $1.75bn bond: one puzzle wrapped up in another

The ingredients were always going to be interesting…

- Ananda Krishnan, or AK, one of Malaysia’s richest tycoons: check.

- 1MDB, a Malaysian sovereign wealth fund: check.

- Goldman Sachs: check.

- Sheikh Mansour-led Ipic of Abu Dhabi: check.

When 1MDB issued what has been touted as Asia’s biggest sole-led dollar-bond sale ex-Japan in May, it almost slipped under the radar. The issue was never meant to be made public but somehow it flicked up on bankers’ screens, sparking caustic commentary. Part of that, no doubt, was sour grapes. But some intriguing questions remain unanswered.

The $1.75bn 10-year bond was essentially a private placement. It was used to finance 1MDB’s purchase from AK of Tanjong Energy, a power group with assets in Malaysia, Abu Dhabi and elsewhere.

According to Reuters’ IFR calculations at the time, the bond priced at 425 basis points over 10-year Treasuries, at a yield just short of 6 per cent. Yet Malaysian oil company Petronas, in a similar business and with a higher rating, was trading at just 185 basis points over comparable Treasuries.

When the pricing was leaked, rival bankers huffed and puffed, berating Goldman for selling 1MDB an expensive, overly-complex structure. If the deal got counted, Goldman would soar up the league tables, waving cheerily at its rivals floundering below.

Well, it did. The league tables paint a pretty picture: according to Dealogic data for DCM dollar-deals ex-Japan, as of Monday Goldman is ranked 4th, compared to 6th for the same period last year.

Goldman declined to comment given that the rival bankers doing the huffing were doing it anonymously.

Yet the pricing of the deal is not its biggest mystery. Bankers are wondering why an Abu Dhabi government investment fund would guarantee what is essentially Malaysian sovereign debt. After all, 1MDB has secured a Malaysian state guarantee in the past. Why is a Gulf emirate, many miles away, guaranteeing this bond?

Sure, guarantees usually command a fee but that would hardly interest Ipic, which is more into multi-billion dollar acquisitions and stakes in global companies. In any event, beyondbrics understands it didn’t get one.

So what did Ipic get? Surely, it has to be related to the underlying assets: the power plants that AK was selling to 1MDB as Tanjong Energy. Tanjong operates nine power plants in Malaysia, Egypt, Bangladesh, Pakistan, Sri Lanka and the United Arab Emirates.

At the time of the deal, 1MDB said:

The acquisition signals the first step towards fulfilling 1MDB’s strategic intent towards fulfilling the country’s long-term energy security… Energy is one of the core focus areas for 1MDB, and [Tanjong Energy] is a prized acquisition.

With elections approaching in Malaysia, Ipic’s positioning in this deal is definitely one to watch. What exactly it is up to, only Ipic can say. Sadly, it didn’t respond to requests for comment.