Whilst Foreign Secretary the front runner in the present Conservative leadership race appeared mainly concerned with selling weapons on behalf of British business, barking at visiting Malaysian dignatories “Aren’t you interested in buying arms?” in lieu of a more conventional welcome. To which the answer has so far been a sensible no.

The question is how will trade and investment flow if Boris takes charge? Brexit to one side (having to an extent performed its purpose in making him leader) it seems likely that Johnson will soon respond to some of the financial interests which supported his rise. These include businessmen behind what is termed as the ‘Commonwealth Agenda’, keen to revive what they see as the UK’s special ties with countries such as Malaysia.

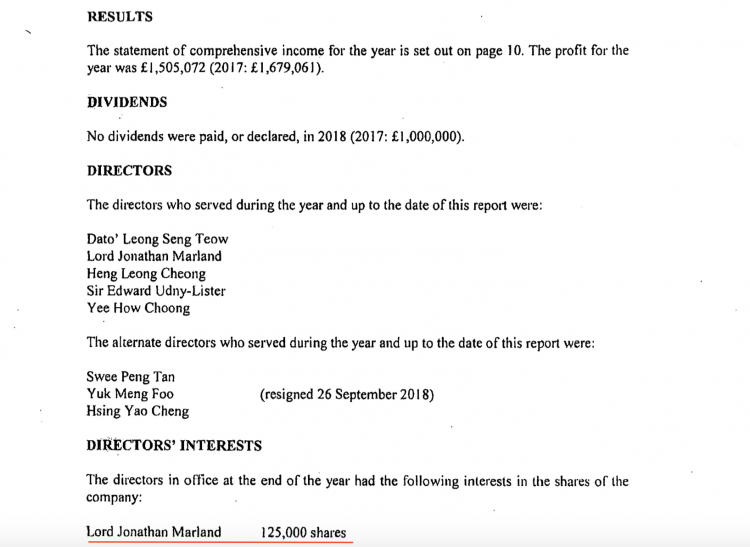

Barely known in the UK, but long since recognised as a key promoter of this agenda and also of former prime minister Najib Razak is Lord Jonathan Marland, who set up a two pound limited company called the Commonwealth Enterprise and Investment Council and appointed himself as Chairman after stepping down from a short stint as a working peer in the Department for Energy in 2014.

The Commonwealth Enterprise and Investment Council (CWEIC) has a ‘small secretariat’ at the Malborough House headquarters of the Commonwealth according to its website and Marland has hired the former Foreign Office minister Hugo Swire (from the Swire commercial family and previously in charge of Malaysian matters) to be his Deputy.

The focus of CWEIC is concentrated on channelling foreign money into the UK as per a new so-called ‘Commonwealth Partnership Programme’ signed last week with the well-known off-shore haven of Jersey purportedly designed to:

“.. unlock opportunities for Jersey to increase its visibility and access to key decision makers in priority Commonwealth markets through CWEIC’s extensive cross-border networks and in-country expertise.

Lord Marland said: “I am delighted the Government of Jersey is strengthening its partnership with CWEIC. Together we will continue to support the ambitions of the Government of Jersey to increase trade across the 53 members countries of the Commonwealth.”

Senator Gorst [of Jersey] said: “I hope … CWEIC’s support will maximise opportunities and encourage UK-based programmes or inward delegations to visit Jersey.”

As readers of Sarawak Report may be aware Lord Marland likewise claims he was the driving force behind the massive investment of Malaysian public money into London’s most costly ever development project at Battersea Power Station during his short term as a minister:

I think the only legacy [of his role] that… lasting legacy will forever exist would be Battersea Power Station which I was the minister responsible for getting that going… it is fascinating seeing the towers coming down and going back up again which I was utterly insistent upon and actually getting the Malaysians, they were brilliant, they are still. …

Q: What do you regard as your big achievement in office?

LM: .. I think opening trade relationships with some of the biggest countries in the world which had completely died. I mean, Malaysia for example, you know, the amount of Malaysia monies coming in… Getting those relationships going and then buying into British. [Lord Marland]

As testimony to his role Marland attended the earth-turning on the project in 2013 together with private developers SP Setia, former PM Najib Razak (Malaysian Government concerns Sime Derby and EPF already owned 60%), former PM David Cameron and the then London Mayor Boris Johnson.

Swiftly, the major shareholder of SP Setia, Liew Kee Sin, managed to sell out his stake in the company to the Minister of Finance (also Najib) controlled fund PNB the following year at what could only be described as a surprisingly advantageous price of RM3.95 for each of his 67 million shares, which was RM1.00 above the market rate.

Having cashed out so handsomely Liew was perhaps equally surprisingly permitted to remain as Chairman thanks to the acquiescence of the new publicly owned shareholders. Meanwhile he transferred most of the SP Setia staff to a new company under his control, namely the now burgeoning property development company Eco World, which soon got down to a number of rival developments next door to Battersea itself in London.

Blind Eye?

So important was this now largely publicly funded Malaysian bail out of what had become London’s biggest white elephant that a minor difficulty such as 1MDB was clearly not to get in the way of Marland’s keen advocacy of continuing Malaysian investment in Britain.

Indeed, Malaysia (together with Malta, another country with a controversial record on corruption) was cited as a ‘Strategic Partner‘ of Marland’s Commonwealth Enterprise and Investment Council Limited (CWEIC) right until the overthrow of the Najib government, despite the scandals enveloping the country.

Only a month after the devastating DOJ asset seizure of 2016, complete with court documents tracing US$731 million of the stolen funds into Najib’s personal account, Marland and his CWEIC hosted Najib as guest of honour at a trade conference at Malborough House, which was used as a vital face-saving event for the Malaysian prime minister – looking for all the world as if it was an official occasion (attended by government ministers and UK High Commissioner Vicky Treadell).

Marland’s close relationship with Malaysia continues. His son now works for the very same property developer Eco-world, started up by Liew Kee Sin and some 280 former employees of S P Setia after he made his killing selling on his interest in Battersea Power Station to the Finance Ministry controlled fund PNB.

And after he left his government post soon after the Battersea deals went through Marland himself also set up as a founding director and substantial shareholder of a UK based subsidiary of Eco World Eco World Management & Advisory Services (UK) Limited .

The former architect of Malaysia’s Battersea investment thus became openly involved in the projects headed by Liew, such as the Embassy Gardens development in Nine Elms alongside the Battersea Power Station development itself (Liew’s Eco World bought into the project originally granted by Wandsworth Council to the UK company Ballymore in 2012).

Najib duly attended the ‘topping out’ of Embassy Gardens in 2016. The development being adjacent to the Battersea project benefits from the major infrastructure investments that form part of the Malaysian Government funded development (in 2017 the cost of that investment sky-rocketed to a record £1.6 billion).

Meanwhile, Lord Marland continues his activities at the Commonwealth Enterprised and Investment Council Ltd, which continues to operate its trade building ventures apparently in tandem with the Commonwealth Secretariat in Malborough House.

Team Boris

These connections are likely to play into UK/Malaysian relations should Boris become PM because another so far not hugely advertised fact is that Lord Marland has long since acted as a key member of what is known as ‘Team Boris’, advocating the progress of the populist politician first as Mayor and now PM.

A former treasurer of the Conservative Party and considered to be a wealthy and effective fundraiser, it was Marland who was reported as organising the finance behind Boris Johnson’s two London mayorial bids, which largely entailed meeting the hefty payments of the top Australian right-wing strategist Lynton Crosby in both those campaigns. Marland’s own Wikipedia page acknowledges he was a “key part of the team which saw the election of Boris Johnson as Mayor of London”

Separately, Crosby is listed as a member of the CWEIC’s Advisory Board.

In recent months Marland is said to have been again involved in discreetly engaging Crosby’s company CTF Partners on behalf of Boris for the leadership campaign. The ties have only recently been acknowledged, but the election guru has himself been quoted making the logical point “you can’t fatten a pig on market day.”

Influence and Communications

Alongside these electioneering connections in the UK it has emerged that the same businessman is also a prominent shareholder in the ‘strategic communications’ firm SCL Group, which became associated with a number infamous antics linked to election campaigns around the world before its subsidiary Cambridge Analytica was caught in the headlines for its role in abusing illegally harvested Facebook data in 2016 to secretly promote Brexit and promote Trump in the US elections.

SCL Group and the Najib government denied reports by Sarawak Report that the company was also engaged to influence the Sarawak State Election in that year (via a contract ostensibly for Petronas), saying there was no such relationship. However, on the eve of the 2018 General Election Sarawak Report obtained and exposed documents indicating that despite a raft of similar denials the company was also working with BN on attempts to shore up no less than 40 threatened seats.

The ties continue, as Sarawak Report has now received reliable information that a senior Crosby employee Sam Lyon was deployed to KL in the run up to the GE14 to open a branch of CTF in Malaysia. Clearly, this particular assignment would not be listed under the heading of great successes on the part of a company that is known to be discreet about its clientelle at the best of times. It is assumed that Lord Marland’s close contacts in UMNO funded the project.

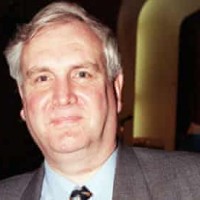

Boris’s Right Hand Man – Sir Edward Lister

There is another interesting connection within this circle that once again indicates that the arrival of Boris at Number 10 might turbo-charge the hunt for Malaysian inward investment into the UK post-Brexit.

The other British national on the board of the Eco World’s London subsidiary is one Edward Lister, famous for his controversial leadership of Wandsworth Council (the local council for Battersea Power Station) during the Thatcher years and later credited for doing most of Boris Johnson’s managerial work as Deputy Mayor and chief of staff during his period as London Mayor.

It has been widely touted that Lister will be drafted back into position at Boris’s side should he enter Number 10 in order to perform the donkey work (of actual government) that Boris is reputed as prefering to avoid. Meanwhile, the former local government boss has also just been renewed for another three years in a pivotal and high profile post in the world of construction as Chairman of Homes England a government agency directed at procuring affordable housing for people in England.

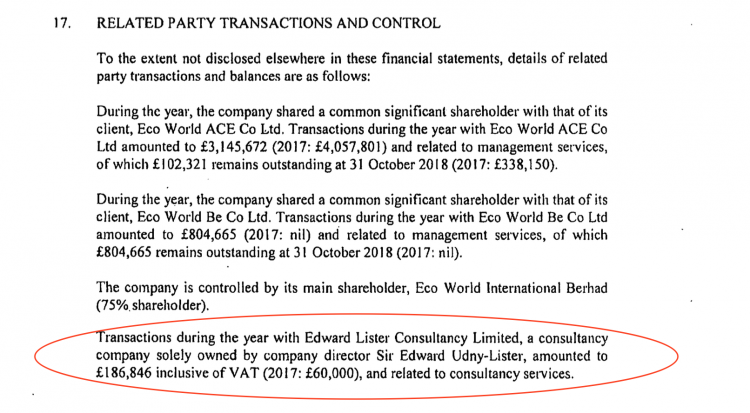

This may not be the remit of Eco World, which is in the business of making a profit. However, Eco World Management & Advisory Services (UK) Limited records having made a substantial payments to Sir Edward Lister as one of its directors. £186,846 was paid in 2018 for services commissioned from a consultancy company solely owned by Lister (in 2017 Lister was paid £60,000).

The purpose of Eco World is to extend its property investments in the UK using foreign inward investment, a pattern that could be seen to mirror the strategy of the Battersea Power Station development, which has been primarily marketed abroad to foreign buyers primarily from South East Asia.

Given the housing crisis in London and the cry for more affordable housing in the capital the focus on foreign buyers has been controversial, but the potential clash of interests has continued.

Earlier in March Lister, who like Marland is an enthusiastic advocate of Brexit and of reviving Commonwealth ties, advised a conference in his capacity as Chair of Homes England that the property industry ought not to worry about Brexit, because the demand for housing would remain voracious, providing enticement for foreign investors in prperty development:

Sir Edward Lister, chair of Homes England, said that the international investors could see the “underlying demand” for new homes in the country, and that this would remain regardless of what happens with Brexit.

Speaking at international property festival MIPIM, Sir Edward said that despite the country now building 240,000 new homes a year there were still 160,000 new households being created every year, leading to a “massive shortfall”.

He said: “The short answer is there is a massive demand for housing and people need to live somewhere. So ignore Brexit – the demand is there.”

Sir Edward was speaking on a panel alongside Nick Walkley, chief executive of Homes England, discussing what the state of overseas investment would be following the UK’s exit from the EU. [Inside Housing]

Ranging between the £350k-£500k (RM1.7m-RM2.5m) the housing units on offer from Eco World in London are clearly targeted at higher end buyers and not the provision of affordable housing. Once again the business in which he and Lord Marland is engaged appears targeted around inward investment to London by places like Malaysia.

Whether there is a conflict between Sir Edward’s public job promoting affordable housing (particularly given a contentious record and the desperate present demand in the capital) and this private role as director of the subsidiary of a foreign property investor and paid consultant is perhaps something for UK observers to consider.

From Malaysia’s perspective the key question is how Boris Johnson and his key fixers and allies will plan to approach Malaysia if he enters Number Ten. Commonwealth countries like KL will be top relationship targets for these Brexiteers, already champing for further deregulation and ‘free ports’ to encourage the influx of what many describe as dubious and secretive foreign wealth. They might even seek to pull the UK out of EU rulings (for example on bio-deisel) as a sweetner for future deals.

But, if the money is being encouraged primarily to flow out of Malaysia and into London property, how much profit is likely to return?